- How much is full coverage insurance?

- Cost of full coverage car insurance by state

- What is full coverage insurance?

- What does full coverage car insurance cover?

- What isn't covered by full coverage?

- Do I need full coverage car insurance?

- Choose the right coverage using our car insurance coverage calculator

- How to get cheap full coverage car insurance

- When should you drop full coverage on your car?

- Methodology

- Auto insurance FAQs

How much is full coverage insurance?

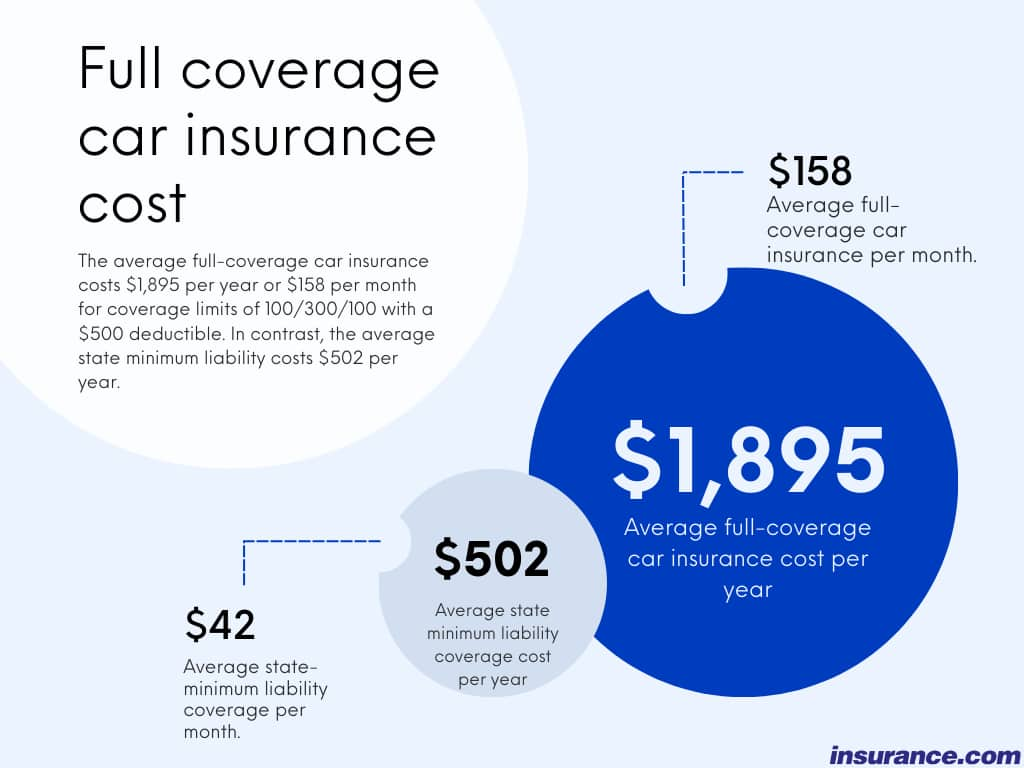

The average full coverage car insurance cost is $1,895 per year, or about $158 per month, according to Insurance.com's most recent data. That’s based on coverage of 100/300/100 ($100,000 per person, $300,000 per incident for injuries and $100,000 for property damage.) The average cost of state minimum coverage, which offers much less coverage, is $502 annually.

Car insurance rates are very specific to the driver: Your age, driving record, credit history and location count, and the kind of car you are driving. Rates vary by hundreds or even thousands of dollars from company to company. That's why we always suggest comparing quotes as your first step to saving money.

Here's a state-by-state comparison of the average yearly cost for:

- State-mandated minimum liability.

- Full coverage with liability of $100,000 per person, $300,000 per accident, and $100,000 for property damage, and a $500 deductible for comprehensive and collision.

Cost of full coverage car insurance by state

Below you'll find the average cost of a full coverage car insurance policy in your state.

| State | State minimum coverage | Full coverage (100/300/100), $500 deductible | Difference |

|---|---|---|---|

| Alaska | $398 | $1,676 | $1,278 |

| Alabama | $433 | $1,860 | $1,427 |

| Arkansas | $397 | $1,957 | $1,560 |

| Arizona | $516 | $1,812 | $1,296 |

| California | $551 | $2,416 | $1,865 |

| Colorado | $437 | $2,337 | $1,900 |

| Connecticut | $704 | $1,725 | $1,021 |

| Washington D.C. | $558 | $2,157 | $1,599 |

| Delaware | $788 | $2,063 | $1,275 |

| Florida | $993 | $2,694 | $1,701 |

| Georgia | $577 | $1,970 | $1,393 |

| Hawaii | $396 | $1,517 | $1,121 |

| Iowa | $260 | $1,630 | $1,370 |

| Idaho | $357 | $1,428 | $1,071 |

| Illinois | $421 | $1,532 | $1,111 |

| Indiana | $417 | $1,515 | $1,098 |

| Kansas | $434 | $1,900 | $1,466 |

| Kentucky | $606 | $2,228 | $1,622 |

| Louisiana | $722 | $2,883 | $2,161 |

| Massachusetts | $511 | $1,726 | $1,215 |

| Maryland | $727 | $1,746 | $1,019 |

| Maine | $335 | $1,175 | $840 |

| Michigan | $604 | $2,266 | $1,662 |

| Minnesota | $475 | $1,911 | $1,436 |

| Missouri | $488 | $1,982 | $1,494 |

| Mississippi | $463 | $2,008 | $1,545 |

| Montana | $350 | $2,193 | $1,843 |

| North Carolina | $476 | $1,741 | $1,265 |

| North Dakota | $349 | $1,665 | $1,316 |

| Nebraska | $331 | $1,902 | $1,571 |

| New Hampshire* | $397 | $1,265 | $868 |

| New Jersey | $853 | $1,902 | $1,049 |

| New Mexico | $421 | $2,049 | $1,628 |

| Nevada | $720 | $2,060 | $1,340 |

| New York | $731 | $1,870 | $1,139 |

| Ohio | $362 | $1,417 | $1,055 |

| Oklahoma | $408 | $2,138 | $1,730 |

| Oregon | $641 | $1,678 | $1,037 |

| Pennslyvania | $375 | $1,872 | $1,497 |

| Rhode Island | $646 | $2,061 | $1,415 |

| South Carolina | $720 | $2,009 | $1,289 |

| South Dakota | $307 | $2,280 | $1,973 |

| Tennessee | $442 | $1,677 | $1,235 |

| Texas | $572 | $2,043 | $1,471 |

| Utah | $582 | $1,825 | $1,243 |

| Virginia | $428 | $1,469 | $1,041 |

| Vermont | $306 | $1,319 | $1,013 |

| Washington | $438 | $1,608 | $1,170 |

| Wisconsin | $365 | $1,664 | $1,299 |

| West Virginia | $510 | $2,005 | $1,495 |

| Wyoming | $288 | $1,758 | $1,470 |

*New Hampshire doesn’t require drivers to have car insurance, but most drivers do, and we’ve listed what is mandated if you choose to carry coverage.

What is full coverage insurance?

Full coverage auto insurance is a policy that includes not only mandatory state coverages, such as liability insurance (and personal injury protection or other coverages in some states), but also comprehensive and collision coverage to protect your car.

As a general rule, liability-only coverage protects others from damage you cause, while full coverage also protects your vehicle.

There's no specific definition of full coverage car insurance; what it looks like for you depends on your state and what coverage you need. While liability plus the addition of comprehensive and collision is what people typically mean by full coverage, you can add a lot more for a policy that might include:

- High liability limits (say, $250,000 per person bodily injury, $500,000 per accident, $250,000 property damage)

- Collision and comprehensive coverage

- Uninsured motorist coverage (bodily injury, property damage or both, which is required in some states)

- Personal injury protection and medical payments (required in some states)

- Rental reimbursement coverage

- Towing and labor/roadside assistance

- Add-ons such as new car replacement, accident forgiveness and other options

- Custom equipment coverage

- Gap insurance

The main difference between liability-only and full-coverage car insurance is that full coverage protects your car no matter who is at fault.

What does full coverage car insurance cover?

A typical full coverage policy includes liability coverage and any other legally required coverages (no-fault coverage in some states), plus comprehensive and collision coverages. Legally required coverages in some states include uninsured motorist, personal injury protection (PIP) and medical payments (MedPay).

A typical full coverage policy includes liability coverage and any other legally required coverages (no-fault coverage in some states), plus comprehensive and collision coverages. Legally required coverages in some states include uninsured motorist, personal injury protection (PIP) and medical payments (MedPay).

If you don’t add any additional coverage, your full coverage policy will cover the following:

- Injuries and property damage you cause to others, up to your chosen limits.

- Damage to your car in a collision, regardless of fault.

- Damage to your car from most non-collision events, including theft, vandalism and weather damage.

- Injuries to you and your passengers if you live in a no-fault state, up to your chosen limits.

Full coverage insurance covers at-fault accidents for injuries and damage to others and your vehicle. It doesn’t cover your own injuries in an at-fault accident unless personal injury protection is added (it’s required in some states and optional in others).

What isn't covered by full coverage?

Full coverage car insurance doesn’t cover everything. Common exclusions are:

- Racing or other speed contests

- Off-road use

- Use in a car-sharing program

- Catastrophes such as war or nuclear contamination

- Destruction or confiscation by government or civil authorities

- Using your vehicle for livery or delivery purposes; business use

- Intentional damage

Typical comprehensive and collision policies won’t cover every situation. Normal exclusions are:

- Freezing

- Wear and tear

- Mechanical breakdown

- Items stolen from the car (those may be covered by your homeowners or renters policy)

- A rental car while your own is being repaired (an optional coverage)

- Electronics that aren’t permanently attached

- Custom parts and equipment (some small amount may be specified in the policy, but you can usually add a rider for higher amounts)

Remember that full coverage isn't an official term; your full coverage policy may not include all available coverage. Look at all your coverage options to ensure you know what's covered and what's not, and add any additional protection you may need.

Do I need full coverage car insurance?

While you are required by law in most states to have liability coverage (and no-fault medical coverage in some states), you are not required by any law to have full coverage.

However, if you owe money on your vehicle, your lender will require that you buy collision and comprehensive coverage to protect its investment. After you pay off the loan, buying comprehensive and collision is your choice.

Here are some rules of thumb on insuring any car:

- When the car is new or financed, you should have full coverage. Keep your deductible manageable.

- When the car is paid off, raise your deductible to match your available savings (higher deductibles help lower your premium).

- When your car is no longer worth enough to make paying for full coverage worthwhile, consider dropping comprehensive and collision.

Choose the right coverage using our car insurance coverage calculator

Use Insurance.com's online car insurance calculator to get a personal recommendation for what kind of car insurance coverage you should buy and what deductibles to consider.

How to get cheap full coverage car insurance

The best way to find the cheapest full-coverage car insurance is to shop around and compare quotes. Insurance companies rate risk differently, which can result in dramatic differences in premium quotes. In addition to shopping around, here are a few tips for getting cheaper full coverage car insurance:

- Raise your deductible. A higher deductible is the easiest way to get lower rates, but make sure you can afford it if you need to pay it.

- Bundle your coverage. You can save on your car and home or renters insurance when you buy from the same company.

- Ask about discounts. There are dozens of possible car insurance discounts available, so make sure you’re getting everything you qualify for.

When should you drop full coverage on your car?

While there is no specific time at which you can or should drop full coverage, there are a few ways to decide.

First, if your loan is paid off and you feel comfortable covering the cost of repairs or replacement after an accident, you may want to drop your comprehensive and collision coverages.

A car's value drops with each passing year, and so do the insurance premiums. At a certain point, most drivers would choose to accept the risk and bank the collision and comprehensive premiums because they would be unlikely to find a reliable replacement with the insurance payout.

Consider how much you are paying for the additional coverage and how much your car is worth. Putting that extra money aside may be the wiser choice. If you don’t have an accident, it stays in your pocket. If you do, hopefully, you’ve saved enough to cover it.

Methodology

Insurance.com commissioned 2023 full coverage insurance rates from Quadrant Data Services for coverage of 100/300/100 with $500 deductibles. Rates were fielded from multiple companies in ZIP codes across the country. Rates are based on a 40-year-old male driver with a clean record, driving a 2023 Honda Accord LX. Content is updated for 2024.

Auto insurance FAQs

How much is full coverage insurance on a new car?

There is no difference in the cost of full coverage car insurance between a new and a used car. That is to say, the answer to the question “How much is full coverage on a used car?” is the same: it depends.

The average cost of full coverage car insurance in 2023 is $1,895, according to Insurance.com data. That will vary based on a wide variety of factors. The car's value is more important than whether it’s new or used.

How much is full coverage insurance a month?

The monthly cost of a full coverage policy varies, but based on the annual national average, the monthly cost would be $158.

Do you have to have full coverage insurance when financing a car?

In almost all cases, the answer to this question is yes. If you are financing your vehicle, your lender will require that you carry minimum full coverage to protect its investment in your vehicle.

What company has the cheapest full-coverage car insurance?

Again, the answer varies, but here are rates from the five cheapest companies of those surveyed by Insurance.com for full coverage, based on national averages in 2023.

| Company | Average rate |

|---|---|

| Geico | $1,763 |

| State Farm | $1,975 |

| Allstate | $2,509 |

| USAA | $1,381 |

| Progressive | $1,998 |

| Farmers | $2,387 |

| Nationwide | $1,548 |

| Travelers | $1,587 |