- What is long-term care insurance?

- How do you get long-term care insurance?

- How much does long-term care insurance cost?

- What is combination life insurance?

- How much does combination life insurance cost?

- How do you get combination life insurance?

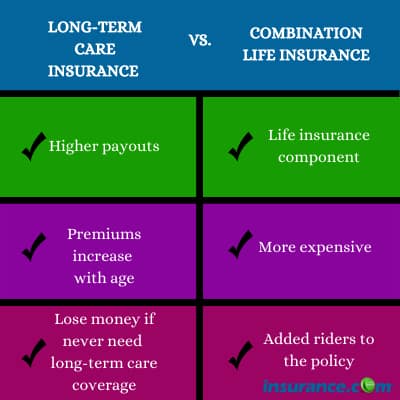

- Differences between long-term care insurance and combination life insurance

- What long-term care plan is right for you?

- How do people pay for long-term care?

- When can you use long-term care protection?

What is long-term care insurance?

Long-term care insurance provides funding for long-term care, including a nursing home or at-home care.

The bad news is that there are only a handful of companies that still offer long-term care insurance. If you’re able to find a policy, you’ll pay a lot more than someone a decade ago.

The reason why fewer companies offer long-term care insurance comes down to costs:

- People are living longer while getting long-term care. That means more money being paid out by insurers.

- Fewer people are buying long-term care policies, which means fewer dollars helping pay for those collecting benefits.

How do you get long-term care insurance?

The first step is to find an insurance company that offers long-term care policies.

You’ll also need a medical exam. The insurer will decide whether you’re a risk.

Younger people have a better shot at getting approval, so it's best to buy insurance young.

How much does long-term care insurance cost?

Long-term care policies can become expensive. State regulators are concerned about the rising costs, but insurers argue the rate increases are needed to help the changing market.

Specific long-term care insurance rates vary by age, health, level of benefits and insurer. Here are 2020 (the most recent data available) annual premiums for a $164,000 policy, according to the American Association for Long-Term Care Insurance:

- Single male, age 55 -- $1,700

- Single female, age 55 -- $2,765

- Couple, age 55 -- $3,050

What is combination life insurance?

Combination life insurance is a permanent life insurance policy with a long-term care insurance rider.

This rider allows you to tap into your long-term care savings if you need it. You don’t pay taxes on it. If you don’t use it, the money will go toward a death benefit.

You can add other riders to the policy like:

- Accelerated death benefits

- Disability income

- Critical illness

Once a doctor signs off, you get a percentage of the overall death benefit for the insurance rider. An example is if you have a $200,000 life insurance policy and a rider for 3% a month for long-term care, you could tap into $6,000 a month for long-term care expenses.

How much does combination life insurance cost?

Combination life insurance isn’t cheap.

A combination life insurance policy may cost you $75,000 if you’re willing to pay one lump sum for the long-term care rider. It may cost more if you spread out the payments over a few years. So, it’s not usually an option for someone who doesn’t have money available.

How do you get combination life insurance?

Unlike long-term care insurance, many insurers offer combination life insurance. If you already have a permanent life insurance plan, you can talk to your insurer about adding a long-term care rider or changing policies.

Since it’s a permanent life insurance plan, you can also add other riders to create a policy that works for you.

Once you find a policy for you, the insurer will likely ask a series of health-related questions and you’ll probably need a medical exam. The insurer will decide about approval and your rates by the answers to those questions and the exam.

Differences between long-term care insurance and combination life insurance

There are many differences between long-term care insurance and combination life insurance. Here are a few of them:

- Combination life insurance provides permanent life insurance as well as long-term care coverage.

- Long-term care insurance is only for long-term care.

- Combination life insurance is more expensive than long-term care insurance.

- Long-term care insurance premiums increase as you age. Combination life insurance premiums are usually consistent.

- You lose any money not spent on a long-term care insurance policy.

- Long-term care insurance usually has larger payouts than combination life insurance.

What long-term care plan is right for you?

It depends on your situation, finances and what you want out of your coverage.

Here are questions to ask yourself:

- What do you want out of a policy? Do you just want long-term care coverage or the ability to transform that money into a death benefit?

- How much money do you have to spend on a policy?

- Do you already have life insurance or do you need a policy?

- Do you have beneficiaries who need a death benefit?

- Are you OK with spending higher rates for long-term care insurance as you age?

The answers to those questions will help you figure out what’s a better choice.

Then, your next step is to talk to a financial planner. Create budgeting and financial modeling to figure out whether you need long-term care protection.

If you feel you need it, shop around and get quotes from multiple companies. You may want to price both long-term insurance and combination life insurance to see which avenue makes sense for you.

How do people pay for long-term care?

Medicare usually doesn’t cover long-term care. Medicare covers your medical expenses, but when it comes to long-term care, you’re generally on your own.

One exception is people who qualify for Medicaid. Medicaid will pick up a portion of the costs of long-term care.

However, if you don’t qualify for Medicaid, you’ll need to figure out a way to pay for long-term care. That could result in your family selling your home to help pay for nursing home care.

Long-term care can cost thousands a month, so having a plan to pay for it is important.

When can you use long-term care protection?

A doctor must diagnose you with cognitive impairment or deem you incapable of performing at least two of six daily living activities:

- Bathing

- Continence

- Getting dressed

- Eating

- Toileting

- Transferring (moving to and from a bed or a chair)

Once a doctor signs off, you’re able to submit claims for your long-term care. Once you get the OK for long-term care insurance, you, your family or your representative can file claims.