- What is the average cost of full coverage car insurance?

- How much is full coverage car insurance in your state?

- How much is full coverage car insurance by age?

- What are the best companies for full coverage car insurance?

- How do you decide if you need full coverage car insurance?

- What affects the cost of full coverage car insurance?

- How can you get cheap full coverage car insurance?

- Methodology

- FAQ: Full coverage car insurance cost

What is the average cost of full coverage car insurance?

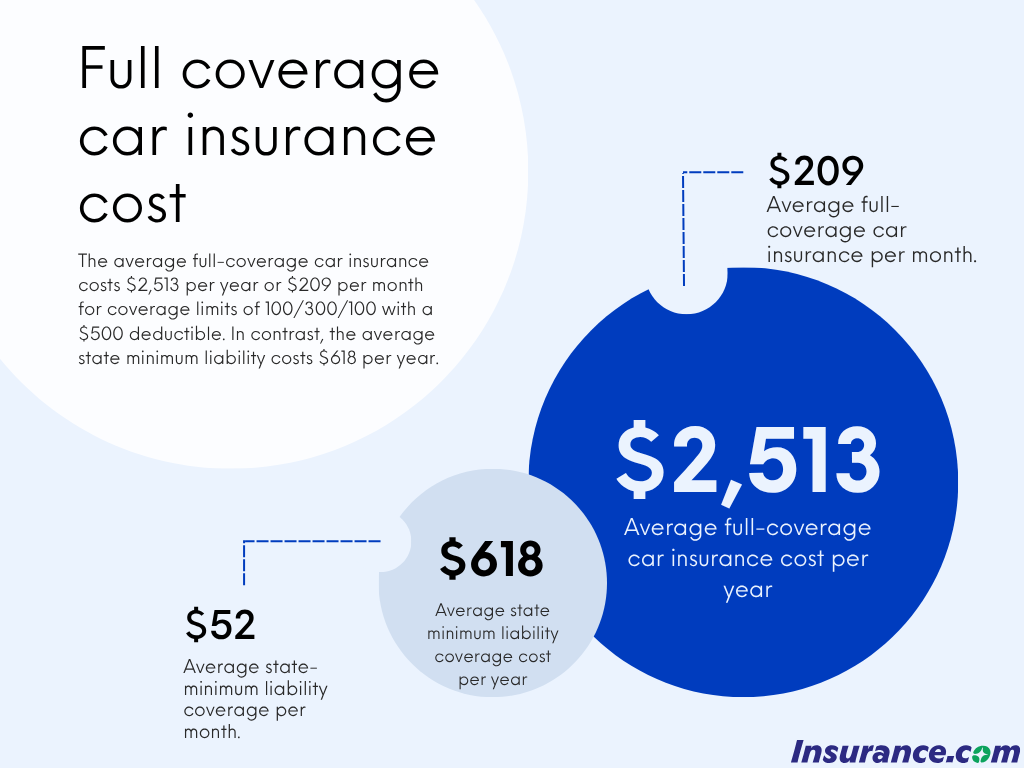

The average cost of full coverage car insurance is $2,513 per year, or about $209 per month. That’s based on liability insuranceLiability insurance covers sums that an insured becomes legally obligated to pay because of bodily injuries or property damage, or financial losses caused to other people. coverage of 100/300/100 ($100,000 per person, $300,000 per incident for injuries, and $100,000 for property damage) and $500 deductibles.

Travelers has the cheapest full coverage car insurance rates, at $175 per month, or $2,103 annually, followed by GEICO and Nationwide. USAA offers cheaper insurance coverage to people who are eligible.

By comparison, the average cost of state minimum coverage is $618 annually. That amount:

- Provides the lowest level of liability coverage you can buy

- Doesn't provide any coverage for your car

Below you’ll find the cheapest companies for full coverage auto insurance.

| Company | Average annual premium | Average monthly premium |

|---|---|---|

| Travelers | $2,103 | $175 |

| GEICO | $2,148 | $179 |

| Nationwide | $2,463 | $205 |

| Progressive | $2,675 | $223 |

| State Farm | $2,874 | $240 |

| Farmers | $3,085 | $257 |

| Allstate | $3,205 | $267 |

| USAA* | $1,572 | $131 |

*USAA only provides coverage to military members, veterans and their families.

People ask

How much is full coverage insurance on a new car?

The average car insurance rate for a full coverage policy on a new car depends on the car's make and model as well as personal factors like your driving record and where you live. Our average car insurance price is based on a 2023 Honda Accord LX.

How much is full coverage car insurance in your state?

Vermont is the cheapest state for full coverage car insurance, with an average car insurance cost of $1,504 annually. The three cheapest states are:

- Vermont: $1,504, $1,009 below the national average

- New Hampshire: $1,650, $863 below the national average

- Maine: $1,701, $812 below the national average

Louisiana is the most expensive state for full coverage car insurance, at $2,883 annually. The three most expensive states for full coverage are:

- Louisiana: $4,180, $1,667 above the national average

- Florida: $3,852, $1,339 above the national average

- Washington, D.C.: $3,394, $881 above the national average

Full coverage car insurance covers different things depending on your state, because state minimum requirements vary. Below you’ll find how much full coverage costs in each state.

| State | Full coverage premium | State minimum premium |

|---|---|---|

| Alabama | $2,107 | $514 |

| Alaska | $2,215 | $415 |

| Arizona | $2,333 | $662 |

| Arkansas | $2,723 | $503 |

| California | $3,010 | $751 |

| Colorado | $3,222 | $547 |

| Connecticut | $2,726 | $1,039 |

| Delaware | $3,097 | $1,277 |

| Florida | $3,852 | $1,208 |

| Georgia | $2,739 | $780 |

| Hawaii | $1,721 | $425 |

| Idaho | $1,791 | $423 |

| Illinois | $1,901 | $462 |

| Indiana | $1,856 | $445 |

| Iowa | $2,228 | $330 |

| Kansas | $2,410 | $520 |

| Kentucky | $2,976 | $708 |

| Louisiana | $4,180 | $993 |

| Maine | $1,701 | $377 |

| Maryland | $2,273 | $815 |

| Massachusetts | $2,430 | $621 |

| Michigan | $3,146 | $714 |

| Minnesota | $2,561 | $585 |

| Mississippi | $2,455 | $510 |

| Missouri | $2,410 | $544 |

| Montana | $2,541 | $422 |

| Nebraska | $2,387 | $369 |

| Nevada | $3,284 | $908 |

| New Hampshire | $1,650 | $447 |

| New Jersey | $2,736 | $1,124 |

| New Mexico | $2,486 | $475 |

| New York | $2,898 | $1,070 |

| North Carolina | $2,587 | $644 |

| North Dakota | $2,079 | $354 |

| Ohio | $1,739 | $390 |

| Oklahoma | $2,705 | $452 |

| Oregon | $1,927 | $715 |

| Pennsylvania | $2,428 | $421 |

| Rhode Island | $2,706 | $761 |

| South Carolina | $2,367 | $682 |

| South Dakota | $2,635 | $382 |

| Tennessee | $2,214 | $515 |

| Texas | $2,631 | $620 |

| Utah | $2,250 | $708 |

| Vermont | $1,504 | $299 |

| Virginia | $1,837 | $528 |

| Washington | $2,175 | $490 |

| Washington, D.C. | $3,394 | $896 |

| West Virginia | $2,557 | $577 |

| Wisconsin | $2,026 | $407 |

| Wyoming | $1,984 | $286 |

*New Hampshire doesn’t require drivers to have car insurance, but most drivers do, and we’ve listed the cost of what is mandated if you choose to carry coverage.

How much is full coverage car insurance by age?

Full coverage car insurance for new drivers is more expensive than for older drivers varies by company. For example:

- At 16, Nationwide has the cheapest average rates at $6,094 a year; Progressive charges

$9,297 - At 30, Nationwide is still the cheapest at $1,626 a year; State Farm charges $2,055

- At 55, Nationwide's rate is $1,380 a year; Allstate charges $2,314

Take a look at the average cost of full coverage car insurance by age below.

| Company | Full coverage premium |

|---|---|

| Nationwide | $6,094 |

| State Farm | $6,368 |

| GEICO | $6,375 |

| Travelers | $6,455 |

| Progressive | $9,297 |

| Allstate | $9,968 |

| Farmers | $11,592 |

| USAA | $6,239 |

*USAA offers coverage only to military members, veterans and their families.

What are the best companies for full coverage car insurance?

Erie is the best full coverage car insurance company, followed by Auto-Owners and Travelers, according to our data. The insurer earned a 4.67 overall Insurance.com score. Auto-Owners and Travelers had scores of 4.65 and 4.62, respectively.

Below is a full list of the top insurance companies for full coverage based on price, NAIC complaint ratio, customer satisfaction and AM Best financial ratings. The total Insurance.com score is calculated out of five using these factors.

| Company | Overall rating | Average premium | Customer Satisfaction | AM Best | NAIC |

|---|---|---|---|---|---|

| Erie | 4.67 | 5.00 | 4.43 | A+ | 0.61 |

| Auto-Owners | 4.65 | 4.74 | 3.97 | A++ | 0.5 |

| Travelers | 4.62 | 4.62 | 4.00 | A++ | 0.49 |

| Nationwide | 4.33 | 4.76 | 4.06 | A | 0.64 |

| Auto Club Group (AAA) | 4.29 | 4.51 | 3.75 | A+ | 0.77 |

| State Farm | 4.27 | 3.23 | 4.24 | A++ | 0.7 |

| GEICO | 4.20 | 3.99 | 4.07 | A++ | 0.91 |

| Progressive | 4.14 | 3.15 | 3.91 | A+ | 0.65 |

| American Family | 4.01 | 4.22 | 4.32 | A | 1.1 |

| Amica | 3.93 | 2.37 | 3.76 | A+ | 0.61 |

| Allstate | 3.78 | 1.32 | 4.04 | A+ | 0.65 |

| Farmers | 3.69 | 1.76 | 4.12 | A | 0.8 |

| Mercury | 3.64 | 2.02 | 3.95 | A | 0.84 |

| CSAA Insurance Group (AAA) | 3.50 | 1.00 | 4.05 | A | 0.75 |

| Auto Club of Southern California (AAA) | 3.30 | 2.07 | 4.15 | A- | 2.21 |

In our rankings, full coverage includes liability limits of 100/300/100 and $500 deductibles.

People ask

Which company has the cheapest full coverage car insurance?

Nationwide has the cheapest full coverage auto insurance rates according to our data, but rates are based on a lot of factors; the cheapest full coverage car insurance companies in your area will differ, as will the cheapest for your particular situation.

How do you decide if you need full coverage car insurance?

Full coverage car insurance is more expensive than liability-only, but it's the right choice for a lot of people.

You should pay extra for full coverage if:

- You have a loan or lease on your car (it will be required)

- You can't afford to repair or replace your car out of pocket

- You have a newer car that would be expensive to repair or replace

- You simply want peace of mind

You can save the money and buy liability-only if:

- You own your car outright

- You have an older, low-value car

- You have the savings to replace or repair your car

What affects the cost of full coverage car insurance?

The factors that affect full coverage insurance rates are based on both liability risk and the potential cost of damage to your vehicle, and include:

- Your age and gender

- Your credit history

- Where you live

- The make, model, and trim level of your car

- Your driving record

- Your annual mileage and commute

Car insurance rates are far more impacted by the make, model, and trim level of your vehicle with a full coverage policy. The more valuable your car, the higher the risk of it being stolen or damaged, and the cost to repair that damage will all affect the cost of insurance coverage for that vehicle.

Use our online car insurance calculator to get a personal recommendation for what kind of car insurance coverage you should buy and what deductibles to consider.

How can you get cheap full coverage car insurance?

The best way to find the cheapest full-coverage car insurance is to shop around and compare quotes. Insurance companies rate risk differently, which can result in dramatic differences in premiumThe payment required for an insurance policy to remain in force. Auto insurance premiums are quoted for either 6-month or annual policy periods. quotes. In addition to shopping around, here are a few tips for getting cheaper full coverage car insurance:

- Raise your deductible. A higher deductible is the easiest way to get lower rates, but make sure you can afford it if you need to pay it.

- Bundle your coverage. You can save on your car and home or renters insurance when you buy from the same company.

- Ask about discounts. There are dozens of possible car insurance discounts available, so make sure you’re getting everything you qualify for.

Methodology

Rate data is sourced through Quadrant Information Services and fielded across all 50 states and Washington, D.C. covering 34,588 ZIP codes.

Unless otherwise indicated, averages are based on our full coverage data set. This data set is based on:

- Bodily injury liability of $100,000 per person and $300,000 per incident

- Property damage liability of $100,000 per incident

- Comprehensive and collision deductibles of $500

- 40-year-old driver

- Honda Accord LX

- Good credit

- A clean driving record

- 12-mile commute, 10,000 annual mileage

Additional rate data is drawn based on:

- Ages ranging from 16 to 75

Best insurance company scores are based on Quadrant rates as well as:

- Customer satisfaction scores from our annual survey of insurance consumers

- National Association of Insurance Commissioners Complaint Index, where a score of 1.00 is considered average.

- AM Best financial stability ratings, which range from D to A++

Learn more about our methodology and data.

FAQ: Full coverage car insurance cost

How much is full coverage insurance on a used car?

As with a new car, the cost of full coverage auto insurance depends on the year, make and model as well as personal factors.

How much is full coverage insurance a month?

The monthly cost of a full coverage policy is $209, based on the annual national average, but rates vary.

Do you have to have full coverage insurance when financing a car?

In almost all cases, the answer to this question is yes. If you are financing your vehicle, your lender will require that you carry minimum full coverage to protect its investment in your vehicle.

Is full coverage car insurance worth it?

As with all insurance, full coverage is worth it if you need to use it. If you can't afford to repair or replace your car, full coverage car insurance is worth having.

When should you drop full coverage on your car?

You can consider dropping full coverage when your car loan is paid off and the value of the car is no longer worth paying for the coverage.