- Compare the types of health insurance plans

- PPO health plans: Wide network, no referrals, higher premiums

- HMO health plans: Limited network, referrals required, low premiums

- HDHP health plans: High deductible, low premiums

- POS health plans: Network options, low premiums

- EPO health plans: Limited network, no referrals, low premiums

- What is the difference between HMO, PPO and HDHP?

- How much do HMO, PPO, EPO, POS health insurance plans cost?

- How do you enroll in a health plan?

- FAQ: Choosing a health plan

Compare the types of health insurance plans

The five most common types of health insurance plans, generally referred to by their acronyms, are:

- Preferred provider organizations (PPOs)

- Health maintenance organizations (HMOs)

- High deductible health plans (HDHPs)

- Point of service plans (POS)

- Exclusive provider organization plans (EPO)

PPOs are the most common type of health plan in the employer-sponsored health insurance market, while HMOs are more common in the individual insurance market. HDHPs comprise about one-third of employer-sponsored plans and have been seen as a lower-cost health insurance option for employers over the past decade. POS and EPO plans are options but less common than HMOs, PPOs and HDHPs.

| Plan type | Provider network | Premium cost | Out-of-pocket costs |

|---|---|---|---|

| PPO | Wide, out-of-network covered | Moderate to high | Low, higher out of network |

| HMO | Limited, no out-of-network coverage | Low to moderate | Low |

| HDHP | Varies, can be HMO or PPO | Low | High |

| POS | Varies, out-of-network reimbursed at a higher cost | Moderate | Varies based on plan structure |

| EPO | Limited, no out-of-network coverage | Moderate | Low |

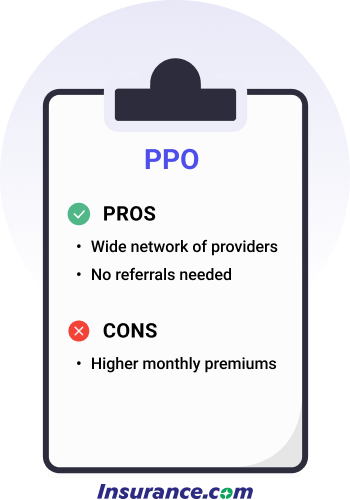

PPO health plans: Wide network, no referrals, higher premiums

PPO stands for preferred provider organization. PPOs are usually more expensive than an HMO and an HDHP and have greater flexibility.

It's the most popular type of plan: KFF reports that 46% of employer-based enrollments are in PPOs.

You usually don’t have to select a primary care provider (PCP) in a PPO plan. A PPO often has more extensive healthcare provider options than an HMO. PPOs allow you to get both in-network and out-of-network care, and you can also see a specialist without a referral.

Provider network and primary care:

A PPO health plan may still require you and a physician to get approval for a costly service, such as an MRI. That's called prior authorization.

Out-of-pocket costs:

PPOs are typically the most expensive in terms of monthly premiums, due to the wide network and easy access to specialists.

PPO plans vary in terms of deductibles, co-pays and coinsurance amounts, but they are generally in proportion to the monthly premiums; a higher monthly premium comes with lower out-of-pocket costs.

You will likely have both an in-network deductible and an out-of-network deductible, as well as higher copays and coinsurance for out-of-network care.

You should choose a PPO if:

- You want to have access to the broadest possible network of providers

- Flexibility and easy access to specialists is important to you

- You would rather pay higher premiums with potentially lower out-of-pocket costs when you need care.

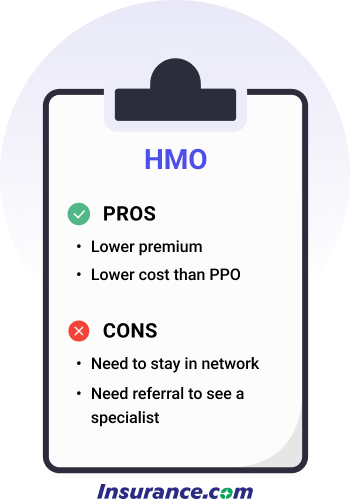

HMO health plans: Limited network, referrals required, low premiums

That smaller network means you sacrifice flexibility for lower costs.

HMO stands for health maintenance organization, making up 12% of employer health plans but about half of the marketplace plans. HMOs are known for lower premiums than PPOs and a restricted network of doctors and hospitals.

Provider network and primary care:

HMOs require that you name a PCP who coordinates care.

Your primary doctor must refer you to a specialist.

HMO plans don’t cover out-of-network care unless it's an emergency.

You'll only be covered for visits to in-network providers.

Out-of-pocket costs:

HMOs generally have lower monthly premiums than PPOs due to the limited care network.

HMO plan deductibles are often lower than for PPO plans, unless your HMO is also an HDHP.

Copays and coinsurance amounts are also typically lower.

When an HMO might be right for you:

- You have a primary care physician and other providers in the HMO network

- You don’t see many specialists and don’t need referrals often

- You don’t mind the limitations of only seeing providers in your network

- Lower premiums are more important to you than flexibility

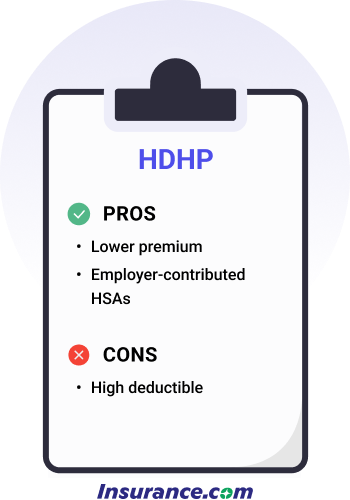

HDHP health plans: High deductible, low premiums

HDHP stands for high-deductible health plan. HDHPs have become popular as more employers offer plans to contain healthcare costs.

Thirty-eight percent of workers have an HDHP. HDHP plans in the marketplace are either Bronze or Silver plans.

Provider network and primary care:

An HDHP may be either a PPO or HMO plan, so the provider network and primary care referral requirements will depend on the type of plan you choose.

Out-of-pocket costs:

An HDHP has a deductible of at least $1,650 for an individual and $3,300 for a family. The high deductibles mean lower premiums.

The average HDHP deductible is $2,750, but 25% of plans have deductibles of $3,200 or more, according to the Bureau of Labor Statistics.

An HDHP's out-of-pocket in-network costs can't exceed $8,300 for an individual and $16,600 for a family.

HDHPs typically feature a Health Savings Account. An HSA allows you to save money pre-tax to pay for qualified medical expenses. Some employers seed money in employee HSA accounts to help pay for care, so you’ll want to see if your employer provides money to employee HSAs when making a health plan decision.

When an HDHP might be right for you:

- You don’t have many healthcare costs and you don’t expect to have many costs over the next year.

- You’d rather pay fewer upfront costs in premiums with the understanding that the higher deductible means you’ll pay more out-of-pocket if you need care.

- You don’t have children and/or a spouse on your plan who may use a lot of healthcare services.

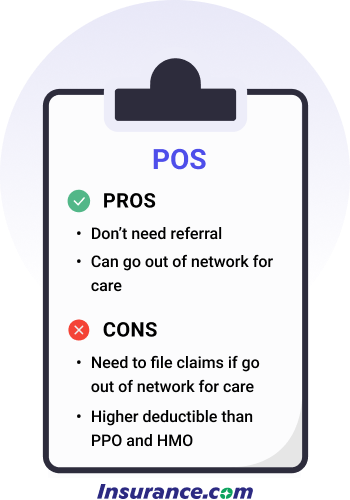

POS health plans: Network options, low premiums

POS stands for point of service plan and makes up only 9% of health plans. POS plans are a hybrid of PPOs and HMOs. Point of service means that healthcare consumers can choose whether to use HMO or PPO services each time they see a provider.

Provider network and primary care:

POS plans usually have similar rules to HMOs. For instance, you need to choose an in-network physician as your PCP. However, you can see an out-of-network physician for a higher fee in a POS plan.

Out-of-pocket costs:

Similar to an HMO, POS plans generally have lower premiums, deductibles and copays/coinsurance.

However, you'll pay more for out-of-network care, and will have to pay up front and be reimbursed.

When a POS might be right for you:

- You have a PCP in the POS plan.

- You want the flexibility of going out of network like a PPO -- and don’t mind paying the higher out-of-pocket fees when you need to go out of network.

- You’re good at keeping healthcare receipts. You don’t mind filling out forms and sending in bills for payment if you get care out of network.

EPO health plans: Limited network, no referrals, low premiums

EPO stands for exclusive provider organization and is a managed care plan that requires you to go to doctors and hospitals in the plan’s network.

Provider network and primary care:

Provider network and primary care:

You don’t need to choose a PCP or need a referral, so in that sense, it’s similar to a PPO, but you will only receive coverage for providers in your network. Other parts of an EPO plan are similar to an HMO, such as having a limited network of doctors and hospitals. You can’t get care outside the network unless it’s an emergency.

Much like a PPO, you need to get approval from your health plan to get what’s deemed an expensive service.

Out-of-pocket costs:

EPO costs are similar to HMOs: low monthly premiums and generally low deductibles, copays and coinsurance amounts.

When an EPO might be right for you:

- You want the flexibility of a PPO and don’t need a referral as long as you stay in-network.

- You’re OK with having a limited network of doctors and facilities like an HMO.

- You want a network like an HMO but don’t want to choose a PCP.

What is the difference between HMO, PPO and HDHP?

It’s open enrollment season at your job, and your employer offers you a choice between the three biggest plan types: HMO, PPO and HDHP. Which is best? It depends on your financial and medical situation – and preferences.

For instance, would you prefer flexibility to choose your providers and don’t mind paying higher premiums? If so, a PPO might be right for you.

Are you OK with a smaller network of providers and want lower costs? In that case, an HMO could be perfect.

Do you rarely use medical services and want a plan that protects you mainly in case of a significant illness or accident? An HDHP is a good choice for you.

Choosing the right health insurance plan is a personal decision and depends on your situation and preferences. Whether you ultimately choose a PPO, HMO, HDHP, POS or EPO, take costs, flexibility, coverage and convenience into account when making that decision.

How much do HMO, PPO, EPO, POS health insurance plans cost?

At $1,299 a year for a single person, HMOs are the cheapest, while for a family, an HDHP plan is cheaper at $5,815 a year. Below, we've compared the average cost of each type of plan for single and family coverage. Rates reflect employer-sponsored plans.

| Type of plan | Average annual premium, single | Average annual premium, family |

|---|---|---|

| HMO | $1,299 | $7,680 |

| PPO | $1,514 | $7,075 |

| HDHP | $1,364 | $5,815 |

| POS | $1,513 | $8,444 |

| EPO | N/A | N/A |

Source: KFF 2025 Employer Benefits Survey. Premiums are based on employer-sponsored plans. EPO plan rates are not available.

How do you enroll in a health plan?

If you’re eligible, you can enroll in a health insurance plan through your employer when you first become eligible, during open enrollment or if you qualify for a special enrollment period.

Employer-sponsored health insurance is how most pre-retirement people get health insurance.

You can also sign up for an individual or family plan through the Affordable Care Act (ACA) marketplace or a similar plan directly from a health insurance company.

Other health insurance options are Medicare and Medicaid if you qualify. Eligibility for those plans is connected to your age (Medicare) and household income (Medicaid).

Health insurance finder tool

COBRA

Learn more about COBRA

How much is your annual household income?

How many members are in your household?

Medicare

Medicare costs vary depending on which option you choose.

Learn more about Medicare costs.

Medicaid

Parent's employer-sponsored health insurance

Spouse's employer-sponsored health insurance

Employer-sponsored health insurance

Preferred-provider Organization (PPOs)

Preferred-provider organization (PPOs) plans are the most common type of

employer-based health plan. PPOs have higher premiums than HMOs and HDHPs, but

those added costs offer you flexibility. A PPO allows you to get care anywhere

and without primary care provider referrals. You may have to pay more to get

out-of-network care, but a PPO will pick up a portion of the costs.

Find out more about the differences between plansHealth maintenance organization (HMO)

Health maintenance organization (HMO) plans have lower premiums than PPOs.

However, HMOs have more restrictions. HMOs don't allow you to get care outside

of your provider network. If you get out-of-network care, you'll likely have to

pay for all of it. HMOs also require you to get primary care provider referrals

to see specialists.

Find out more about the differences between plansHigh-deductible health plans (HDHPs)

High-deductible health plans (HDHPs) have become more common as employers look

to reduce their health costs. HDHPs have lower premiums than PPOs and HMOs, but

much higher deductibles. A deductible is what you have to pay for health care

services before your health plan chips in money. Once you reach your deductible,

the health plan pays a portion and you pay your share, which is called

coinsurance.

Find out more about the differences between plansExclusive provider organization (EPO)

Exclusive provider organization (EPO) plans offer the flexibility of a PPO with

the restricted network found in an HMO. EPOs don't require that members get a

referral to see a specialist. In that way, it's similar to a PPO. However, an

EPO requires in-network care, which is like an HMO.

Find out more about the differences between plans

Learn more about individual insurance plans

Sources:

- KFF. "2025 Employer Health Benefits Survey." Accessed October 2025

- Bureau of Labor Statistics. "High deductible health plans and health savings accounts." Accessed October 2025.

FAQ: Choosing a health plan

What is the difference between an HMO and a PPO?

PPOs and HMOs are the two most common health insurance benefit design types. Here’s how they differ:

- PPOs allow members to get out-of-network care -- often at a higher cost than in-network care. HMOs don’t typically reimburse for out-of-network care unless it’s an emergency.

- HMOs usually require members to choose a primary care physician; PPOs don’t require a PCP.

- HMOs often demand a primary care provider referral for members to see specialists; PPOs don’t require referrals.

What is the difference between a PPO and an EPO?

PPOs and EPOs both don’t demand a referral to see specialists and don’t require that members choose a primary care provider, but they differ in a few ways:

- EPOs won’t reimburse for care outside of your provider network; PPOs allow out-of-network care but usually at higher out-of-pocket costs than in-network care.

- PPOs usually have wider networks than EPOs, which could make finding a provider in an EPO harder than a PPO.

What is the difference between a PPO and a POS?

PPOs and POS don’t require referrals to see specialists and both allow out-of-network care. Here’s how they’re different:

- POS plans allow out-of-network care, but members usually have to file paperwork, which doesn’t happen in a PPO.

- POS plans often have higher deductibles than PPOs.

- POS plans require that you choose a primary care provider; PPOs don’t demand that.

What is the difference between an HMO and a POS?

Members have to receive in-network care for both POS and HMO plans and both types of plans have restricted networks. They’re different in one fundamental way:

- POS plans don’t require referrals to see specialists, but HMO plans demand a referral to see a specialist.

What is the difference between an EPO and a POS?

POS and EPO plans don’t require provider referrals to see specialists, but here’s how they’re different:

- POS plans let you get out-of-network care; EPO plans do not.

- POS requires choosing a primary care provider, while EPOs don’t.

Why are the premiums for a PPO more expensive than those for an HMO?

A PPO gives you much more coverage than an HMO and also comes with the flexibility to visit out-of-network doctors and hospitals – a setup that costs more to deliver, resulting in a higher monthly premium. PPOs also have a much wider network of doctors and hospitals, and also allow you to see a specialist directly; with an HMO, you are often required to see your primary care physician before going to a specialist.

Which type of health insurance plan typically has the lowest deductibles?

HMOs generally have the lowest deductibles. However, some PPO plans, particularly Gold and Platinum plans through the ACA, have very low deductibles.