Pros and cons of an umbrella insurance policy

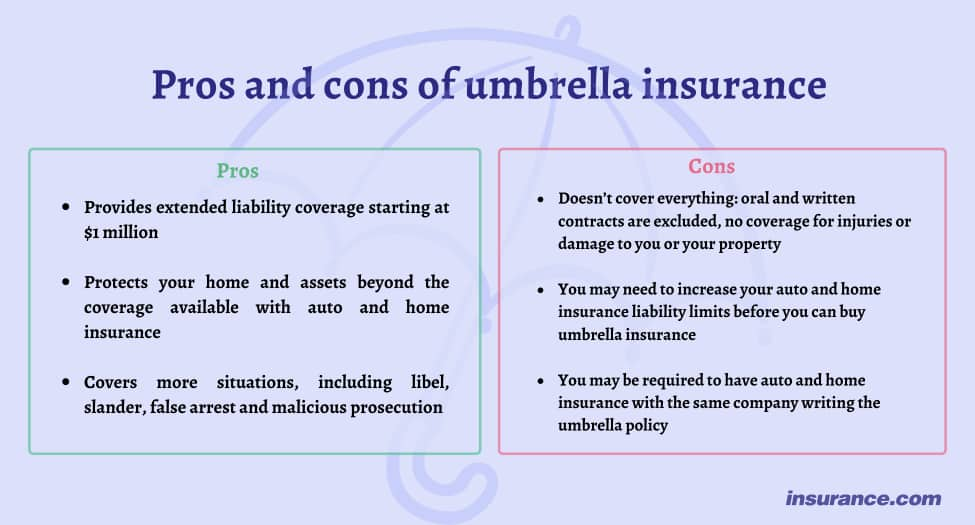

There are both pros and cons to buying an umbrella insurance policy, although for most people the benefits outweigh the disadvantages. Umbrella insurance covers much more than either your auto or home insurance, but there are some caveats.

Pros

- Umbrella insurance provides a lot of coverage, starting at $1 million, for a low cost.

- An umbrella policy helps to protect your assets, including your home, if you’re found to be liable or negligent for injuries or damage.

- Umbrella insurance starts where your home or auto coverage leaves off, meaning it’s an additional limit on top of that limit, creating a much larger pool of resources in a lawsuit or claim.

- Umbrella insurance covers things home and auto don’t, like libel or slander, malicious prosecution and false arrest.

"The benefits of umbrella insurance are to offer additional liability protection beyond what you might have under your auto and/or homeowners policies. Umbrella insurance is a relatively low-cost insurance, relative to the amount of coverage," says Patrick A. Cozza, executive in residence at Silberman College of Business, Fairleigh Dickinson University.

Cons

- Umbrella insurance doesn’t cover everything; it doesn’t cover personal property, your injuries, written or oral contracts, war or terrorism or business losses, for example.

- Generally, you can’t buy umbrella insurance unless you buy the highest available amount of home and auto liability protection, which means your home and auto insurance rates will be higher.

- You may have to buy umbrella insurance through the same insurer as your home and auto; if your current company doesn’t offer it, that might mean switching.

People ask

What are the disadvantages of umbrella insurance?

An umbrella insurance policy does come at an additional cost and requires that you carry high underlying liability coverage limits. It doesn't cover every possible situation. However, for people with a high level of risk, these points may be caveats more than actual disadvantages and are unlikely to outweigh the benefits of umbrella insurance.

Do you need an umbrella insurance policy?

Anyone with a high net worth should buy umbrella insurance, but if you’re not sure, it’s best to consult with a financial advisor. Liability claims can easily exceed auto and home policy limits, and those with a lower net worth may be less able to handle additional court costs or judgments.

However, there are costs involved in buying more coverage, so take the time to be sure it’s right for you. "Like most insurance, it's best to shop around for the lowest premiumThe payment required for an insurance policy to remain in force. Auto insurance premiums are quoted for either 6-month or annual policy periods.," Cozza says.

FAQ: Umbrella insurance

Is umbrella insurance worth it?

As with all insurance policies, an umbrella insurance policy is worthwhile when you need it. For those with an elevated risk of a liability claimAn insurance claim is a request you make to your insurance company for coverage after your car is damaged or you have an accident. You can file a claim online, by phone, or in writing., umbrella insurance cost is worthwhile for peace of mind alone.

When should you buy umbrella insurance?

You should purchase umbrella insurance coverage when your assets outgrow your underlying policy limits. Look at your homeowners insurance and auto insurance liability coverage, and determine whether they are enough to protect your assets.

Who needs umbrella insurance?

Anyone who has assets that would not be adequately protected by either their auto or homeowners insurance limit, even when increased to the highest possible levels, needs umbrella insurance.