- Does Washington have government auto insurance for low-income drivers?

- Washington minimum car insurance requirements

- Best low-income car insurance in Washington

- Cheapest low-income car insurance in Washington

- Car insurance discounts for low-income drivers in Washington

- Methodology

- Low-income car insurance in Washington: Frequently asked questions

- Compare low-income car insurance rates in Washington with other states

Does Washington have government auto insurance for low-income drivers?

Washington doesn’t have a government-run auto insurance program for low-income drivers. But you can look for discounts, usage-based insurance or check with nonprofit groups for help finding affordable car insurance.

Low-income drivers in Washington are still required to get the minimum car insurance required by law. The best way to save money is to compare prices from different companies.

Washington minimum car insurance requirements

The minimum car insurance requirements in Washington are as follows:

| Minimum liability coverage limits | 25/50/10 |

| Average annual premium | $438 |

| Other types of insurance required (if any) | - |

Remember that if you have a loan on your car, you're required to carry full coverage, which includes collision and comprehensive.

Best low-income car insurance in Washington

PEMCO came out on top as the best pick for low-income car insurance.

People on a tight budget still deserve great service from their car insurance company. We gathered the data on the top car insurance companies in Washington and compared them on rates for state-minimum coverage, financial stability and customer satisfaction based on J.D. Power and National Association of Insurance Commissioners (NAIC) scores.

These are the best low-income car insurance companies in Washington.

| Company | Average annual premium | J.D. Power | AM Best | NAIC | Insurance.com score |

|---|---|---|---|---|---|

| PEMCO | $158 | 831 | B++ | 0.24 | 3.53 |

| Travelers | $398 | 810 | A++ | 0.49 | 3.21 |

| GEICO | $296 | 797 | A++ | 0.91 | 3.2 |

| State Farm | $410 | 821 | A++ | 0.7 | 3.16 |

| Nationwide | $496 | 810 | A+ | 0.64 | 2.81 |

| Farmers | $450 | 796 | A | 0.8 | 2.75 |

| Progressive | $595 | 807 | A+ | 0.65 | 2.66 |

| Allstate | $639 | 783 | A+ | 0.65 | 2.6 |

| American Family | $709 | 820 | A | 1.1 | 2.08 |

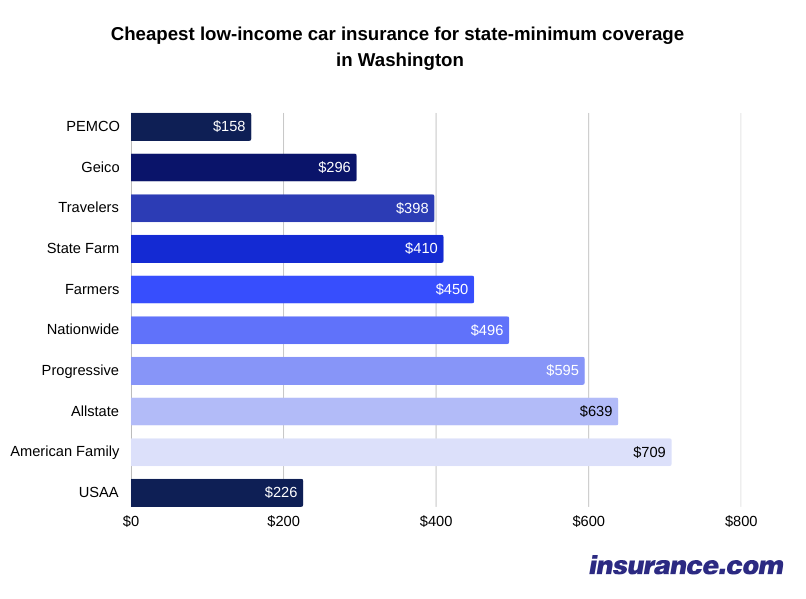

Cheapest low-income car insurance in Washington

Based on state-minimum coverage, we found that the cheapest car insurance company in Washington is PEMCO at an average rate of $158 a year.

When you're working with a tight budget, price is the number one consideration. We gathered rates from car insurance companies in Washington to find the cheapest options on average.

| Company name | Average annual premium | Average monthly premium |

|---|---|---|

| PEMCO | $158 | $13 |

| GEICO | $296 | $25 |

| Travelers | $398 | $33 |

| State Farm | $410 | $34 |

| Farmers | $450 | $37 |

| Nationwide | $496 | $41 |

| Progressive | $595 | $50 |

| Allstate | $639 | $53 |

| American Family | $709 | $59 |

| USAA | $226 | $19 |

PEOPLE ASK:

What can I do if I can't afford car insurance in Washington?

If you can't find affordable car insurance in Washington, try working with a local agent who knows the market and some of the smaller insurance companies available. Consider a usage-based program to reduce costs, reduce coverage, drive less and ask about additional discounts.

Car insurance discounts for low-income drivers in Washington

Discounts are the best way to bring down your car insurance rates. There are a number of discounts low-income drivers in Washington can take advantage of for cheaper insurance. Take a look at some common discounts and how much you can save below.

| Discount type | % Discount |

|---|---|

| Years Licensed | 23% |

| Years Insured | 15% |

| Payment Type | 11% |

| Electronic Signature | 10% |

| Multi Policy | 9% |

| Primary Use | 8% |

| Telematics | 6% |

| Loyalty - Years Renewal With Company | 6% |

| Days Advanced Purchase | 6% |

| Education | 6% |

| Electronic Funds Transfer | 5% |

| Marital Status | 4% |

| Homeowner | 4% |

| Lower Annual Mileage | 3% |

| Safety Devices | 3% |

| Air Bags | 3% |

| Paperless/Electornic Documents | 2% |

| Daily Commute | 1% |

| Anti-Theft Device | 1% |

ASK AN EXPERT Our experts are here to provide real answers to your insurance questions. Is there something you want to know? Ask below.Expert answers to your questions

Leslie Kasperowicz

Executive editor.

Leslie Kasperowicz

Executive editor.

Ask an expert

Methodology

Insurance.com commissioned car insurance rates from Quadrant Data Services in late 2023 for state minimum car insurance policies across all states. Rates are based on a 40-year-old driver with a clean driving record and good credit, driving a Honda Accord LX. We compared rates from 170 companies across 35,488 ZIP codes.

Low-income car insurance in Washington: Frequently asked questions

What is the cheapest car insurance company for low-income people?

In Washington, PEMCO is the cheapest car insurance company with the average rate of $158. However, that's based on average rates and may differ for you, so it's important to shop around.

Does Washington have car insurance for low-income individuals?

No, Washington doesn't offer a car insurance program for low-income individuals or families.

What happens if I can't pay my car insurance?

If you don't pay your car insurance bill, your car insurance will be canceled and you won't have coverage. If you can't pay your car insurance bill, contact your insurance company before the bill is past due to see if you can make arrangements for payment.

Compare low-income car insurance rates in Washington with other states

You might also be interested in

You might also be interested in- Washington car insurance laws and requirements: What is changing in 2025

- Washington DUI and insurance: How much does a DUI raise your insurance?

- Speeding ticket calculator in Washington

- SR-22 insurance in Washington

- Non-owner car insurance in Washington: Best and cheapest companies

- Washington gap insurance: Everything you need to know

- Washington car insurance coverage calculator

- Washington car insurance guide

- Cheapest car insurance for high-risk drivers in Washington

- Cheapest home and auto insurance bundle in Washington