- Our recommendation: Seniors home insurance

- Homeowners insurance for senior citizens

- What coverage should seniors look for in their home insurance policy?

- Cheapest homeowners insurance for seniors

- Best homeowners insurance for seniors

- Are there seniors discounts on home insurance?

- How to find affordable homeowners insurance for seniors

- How to buy home insurance for seniors

- FAQ: Home insurance for seniors

Our recommendation: Seniors home insurance

Home insurance rates are going up. Our experts recommend that seniors shopping for home insurance:

- Work with an experienced agent who can help tailor coverage to avoid overpaying

- Shop around to compare rates from multiple companies

- Ask about discounts

- Consider companies that cater to seniors

Homeowners insurance for senior citizens

Finding affordable homeowners insurance for seniors isn’t difficult unless you live in a high-risk area prone to natural disasters. Florida, for instance, is a popular retirement spot, but hurricanes have made home insurance expensive and hard to find in some areas.

Senior citizens may have paid off their mortgage, which means home insurance is no longer a requirement. However, unless you have enough savings to repair or replace your home if something goes wrong, canceling your home insurance when your mortgage is paid off is not a good idea.

What coverage should seniors look for in their home insurance policy?

Seniors need to make sure they have enough coverage to fully protect their home from a variety of risks. Here are the five basic coverages your home insurance policy includes:

- Dwelling coverage. Ensure you have enough to cover the full replacement cost of your home.

- Other structures coverage. This covers anything not attached to your house, like a fence or detached garage, and is usually 10% of your dwelling coverage.

- Personal property coverage. Usually a percentage of your dwelling coverage, you can increase or decrease this as needed.

- Liability coverage. Experts recommend at least $300,000 in liability coverage to protect against lawsuits that can happen at any age.

- Additional living expenses. This provides coverage for expenses you incur if you can't live at home during repairs from a covered loss.

Other coverage seniors should consider:

- Flood insurance. Especially if you live in a coastal area, it's important to have flood insurance since home insurance doesn't cover floods.

- Extended replacement cost coverage. Adding an endorsement for extended coverage on your house means you're protected against inflation.

- Replacement cost coverage for personal property. Without this endorsement, your personal property may only be protected for its depreciated value, including expensive medical or mobility equipment.

Cheapest homeowners insurance for seniors

Our data indicates that Allstate is the cheapest home insurance company nationally, with an average annual rate of $2,098, followed by State Farm at $2,169. Home insurance for seniors doesn't differ in terms of rates from that of other homeowners. Seniors can find affordable homeowners insurance at the same companies that are the cheapest overall.

Since rates to vary by state, it's important to consider home insurance rates in your state, as well.

| Company | Average annual premium | Average monthly premium | $ Difference vs. national average |

|---|---|---|---|

| Allstate | $2,098 | $175 | $503 less |

| State Farm | $2,169 | $181 | $432 less |

| Nationwide | $2,746 | $229 | $145 more |

| Progressive | $3,193 | $266 | $592 more |

| Farmers | $3,194 | $266 | $593 more |

| Travelers | $3,701 | $308 | $1,100 more |

| USAA | $2,506 | $209 | $95 less |

Best homeowners insurance for seniors

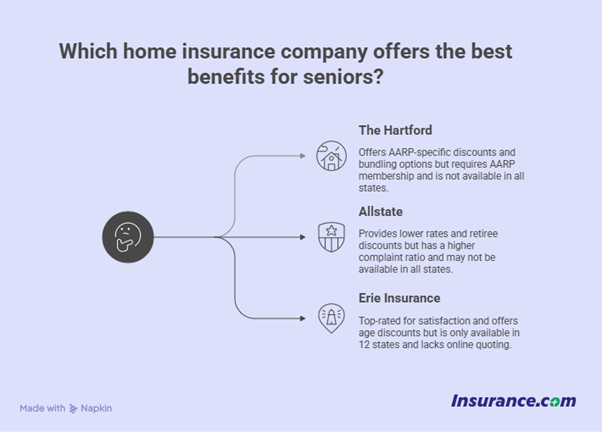

There’s no easy way to determine the best home insurance companies for seniors because being a senior doesn’t have a major impact on coverage or rates. That said, our editorial team identified a few companies that offer some perks to senior homeowners.

The Hartford

The AARP Home Insurance Program from The Hartford is the only home insurance program designed specifically for seniors. You’ll need to be an AARP member to qualify, which costs $16 a year. The Hartford ranked above-average in J.D. Power's 2025 U.S. Home Insurance Study with 647/1,000.

Pros:

- Special discounts and savings especially for AARP members

- Bundling discount with the AARP Auto Insurance Program from The Hartford

- Highly rated

Cons:

- Not available in all states

- Must join AARP to qualify, which has an annual fee

Allstate

Allstate’s 55+ and retired discount can get you cheaper home insurance rates with one of the biggest insurance companies in the nation. Allstate ranked third on our 2025 best home insurance companies list.

Pros:

- Lower-than-average rates

- Offers a retiree discount

Cons:

- 55+ discount may not be available in all states

- Higher than average complaint ratio with the National Association of Insurance Commissioners (NAIC)

Erie Insurance

Erie is one of J.D. Power’s above-average picks for home insurance, ranking No. 3 for overall satisfaction and No. 7 for claims satisfaction. It also ranked No. 1 among regional insurers in our best insurance companies ranking for home insurance. That makes Erie a top pick for homeowners of any age, including seniors.

Pros:

- Top-rated by J.D. Power

- An age of insured discount is available on some policies

Cons:

- Only available in 12 states

- No online quoting

Are there seniors discounts on home insurance?

Few insurance companies have a discount that’s specifically for seniors, but The Hartford’s home insurance program does offer discounted rates to AARP members. The Hartford partners with the AARP to provide home insurance that’s designed for seniors.

Home insurance rates aren’t affected by age the way car insurance rates are, either. However, some companies, notably Allstate, do offer a discount on home insurance for retirees.

Myths vs. Facts: Home Insurance

How to find affordable homeowners insurance for seniors

While discounts for seniors are few and far between, that doesn’t mean cheap home insurance rates for seniors aren’t out there. To get the best price on home insurance, follow a few simple steps:

- Compare quotes from multiple companies. The company with a senior discount might not be the cheapest.

- Ask about additional discounts, like being claims-free or installing a security system.

- Compare rates both with and without the auto and home bundling discount; it’s not always cheaper to bundle.

- Discuss your coverage needs with an insurance agent or broker. While it’s usually not wise to drop coverage just to save money, you shouldn’t pay for coverage you don’t need, either.

“Insurers generally tie [dwelling, personal property, and other structures] coverages together and are reluctant to let people reduce PP and OS without reducing [dwelling] coverage - but we're urging consumers to try and get that accommodation - but keep their structure fully insured,” Bach says.

How to buy home insurance for seniors

Shopping for home insurance is straightforward but can be time-consuming. Use these tips to make buying a policy easier.

- The companies above are a great starting point when shopping for home insurance, but there are a lot of small companies out there that may offer a better deal, even if they don’t specifically cater to seniors.

- Talk to a local agent about getting quotes from some of the regional companies that serve your area; you might be surprised at the prices you’re quoted. “Getting help from an experienced insurance professional is super important in today's challenging market - they can find options you can't find on your own, and they can help you weigh your options and make good choices,” Bach says.

- Loyalty to an insurance company can be rewarded with discounts, and as a senior, you may have been with your insurance company for a long time. But it’s important to consider your options. If loyalty is holding you back, remember that you might save a lot more than what a loyalty discount offers with another company.

Bottom line? Our experts recommend finding an insurance company you trust, with a good claims reputation, that offers solid coverage and great rates, regardless of whether that company caters to seniors.

Sources:

- J.D. Power. "J.D. Power U.S. Property Claims Satisfaction Study." Accessed September 2025.

- J.D. Power. "J.D. 2025 U.S. Home Insurance Study." Accessed September 2025.

FAQ: Home insurance for seniors

Is home insurance cheaper if you are retired?

Retirement doesn’t affect home insurance the same way it does car insurance. Car insurance rates tend to decrease after retirement because you’re on the road less. And while some retired people spend more time at home, others travel more, leaving homes unattended for long periods.

That means homeowners insurance for seniors is generally not cheaper, at least not just because you’re retired. Home insurance rates are based more on location and factors about the house itself than on who lives there.