- Do motorcycles need insurance?

- How does motorcycle insurance work?

- Types of motorcycle insurance

- What does motorcycle insurance cover?

- What isn't covered by motorcycle insurance?

- How much is a motorcycle insurance policy?

- Is motorcycle insurance cheaper than car insurance?

- Sport vs. touring vs. cruiser: How your motorcycle choice affects your insurance rates

- Are there motorcycle insurance discounts?

- Can I bundle home and motorcycle or get a multi-policy discount?

- The most frequent causes of motorcycle insurance claims

- FAQ: Motorcycle insurance

Do motorcycles need insurance?

Motorcycles need to be insured because, in most states, motorcycle insurance is required by law. The amount of coverage you need varies from state to state. Even if you live in a state where insurance isn't required, getting insurance for your motorcycle is more than just a good idea. It protects your investment in your motorcycle and protects you from financial fallout if you injure someone else or cause property damage.

If you have a loan on your motorcycle, you will be required to carry full coverage insurance.

How does motorcycle insurance work?

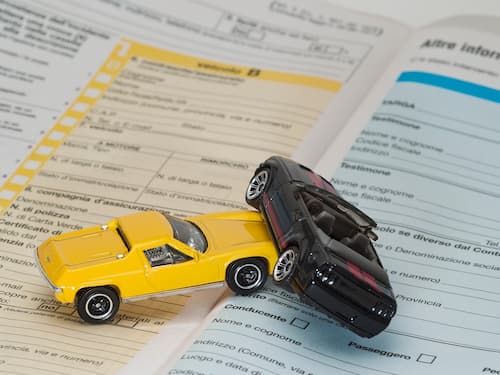

Motorcycle insurance works the same way as car insurance. You pay a premium, and if something goes wrong, you file a claim.

Like car insurance, motorcycle insurance will pay for injuries or damage you cause to others. And, if you carry the right coverage, it will also cover damage to your motorcycle, either from an accident or from theft, vandalism or other non-collision damage.

And, again as with car insurance, you are required to carry proof of insurance to meet state financial requirements.

Types of motorcycle insurance

Many types of vehicles fall under the motorcycle classification for insurance purposes. You can use motorcycle insurance to cover the following:

- ATVs

- Cruisers

- Dirt bikes

- Racing bikes

- Scooters

- Sport bikes

- Touring bikes

- Trikes

The exact list of vehicles and coverage requirements may depend on the insurer you use. So be sure to ask if your vehicle qualifies for motorcycle insurance when shopping around.

What does motorcycle insurance cover?

Motorcycle insurance covers the same things a car insurance policy does, with some motorcycle-specific coverage. Recommended motorcycle insurance coverage includes:

- Bodily injury and property damage liability. Liability insurance pays for injuries and damage you cause to others. In nearly every state, you are required to have liability motorcycle insurance coverage.

- Comprehensive and collision coverage. Collision insurance covers damage to your bike in a crash, while comprehensive insurance for motorcycles covers theft, vandalism and any other damage that's not from a crash. If you've taken out a loan for your motorcycle, your lender will require full coverage.

- Guest passenger liability. Provides coverage for injuries to passengers on your bike who are not part of your household.

- Uninsured/underinsured motorist coverage. Uninsured or underinsured motorist coverage kicks in if you get into an accident with someone and they're at fault, but they don't have insurance or enough insurance to pay for damages done to you and your bike.

- Medical payments. This coverage helps to cover medical costs for you, household members, and passengers, regardless of fault. It can fill in some of the gaps in your health insurance, and there is no deductible.

- Personal injury protection (PIP). Personal injury protection is no-fault medical coverage for you, regardless of fault, that is more comprehensive than medical payments coverage. It's required by law in some states and can cover not only medical bills but lost wages and funeral costs.

- Equipment coverage. `You can also add coverage for equipment and gear, such as jackets, boots, saddlebags, and other expensive equipment unique to motorcycles.

Expert Advice

Kevin Hamill

Co-owner and insurance agent at Quantum Assurance International in Delaware

Insurance coverage for motorcycles works very similarly to coverage for your car, according to Kevin Hamill, co-owner and insurance agent at Quantum Assurance International in Delaware. At minimum, you should have sufficient liability coverage. If you have a loan on the motorcycle, you will be required to carry collision and comprehensive coverage. "If you own the bike outright, the choice is yours," Hamill says.

What isn't covered by motorcycle insurance?

There are some situations when your motorcycle insurance doesn't apply. They include:

- Racing, competition or track days

- Illegal activity

- Wear and tear or equipment breakdown

- Business use, such as making deliveries

How much is a motorcycle insurance policy?

It varies, but the average cost of full coverage motorcycle insurance is generally less than car insurance. The cost of a motorcycle insurance policy varies depending on factors such as your state, coverage level, usage, age, credit score and more. Generally, motorcycle insurance is not expensive.

"The minimum cost I have seen is $40 per year, but typically, it ranges from $250 to $1,500 per year," Hamill said.

That means you could expect to pay less than $20 per month. For instance, the average rate for Progressive motorcycle insurance with liability-only coverage is $12.29 per month in low-cost states and $17.20 per month in high-cost states.

Of course, if you have a particularly expensive bike, poor driving record or credit, little experience riding, etc., you can expect to pay more. And full coverage will have an additional cost.

PEOPLE ASK

Do you need full coverage on a financed motorcycle?

Yes, your lender will require that you carry comprehensive and collision coverage to protect its investment

Is motorcycle insurance cheaper than car insurance?

Motorcycle insurance is usually cheaper than auto insurance but can still be expensive. The main factors that affect how much motorcycle insurance costs are your age, where you live, and the type of motorcycle you have. Younger or less experienced riders usually pay more for motorcycle coverage than those with years of safe riding experience. And if you live in an area where motorcycle theft is common, you will likely have to pay more for insurance.

Sport vs. touring vs. cruiser: How your motorcycle choice affects your insurance rates

The type of bike you own can have an impact on rates.

- Cruisers are often considered good bikes for commuting and leisure riding.

- A touring bike is usually chosen for riding long distances. Those tend to be bigger bikes, with larger fuel tanks and seating for a passenger, among other features.

- Sports bikes are built primarily for speed.

You might think that the sports bikes would be the most expensive and cruisers and touring bikes less so, but it doesn't come down to that.

When it comes to getting a motorcycle insurance quote online, motorcycles are a lot like cars. The more expensive the model and the bigger the engine, the higher your quotes will be.

Other factors that affect motorcycle insurance rates

Your insurer will also look at things like:

- Safety features: Advanced safety features mean lower rates.

- Safety reputation: Safety ratings and crash statistics affect rates.

- Theft track record: Frequently stolen models will see higher rates.

- Your safety record and driving history: If you have a lot of speeding tickets in your past, that can kick up your premiums.

PEOPLE ASK

Do you need insurance for a sport bike?

Yes. You need insurance for a sport bike. All motorcycles ridden on the road must meet state insurance requirements.

Are there motorcycle insurance discounts?

As with other types of insurance, motorcyclists usually want cheap motorcycle insurance. We've talked about the factors that go into determining rates. But there are ways to save, too.

- Bundle: If you bundle insurance, you should get a discount (more on this below).

- Avoid accidents: After a few years of safe driving, you should see lower rates.

- Anti-theft discounts: If you have safety equipment to prevent theft or help catch a thief, such as a GPS-driven location device on your bike, you may be able to get a pretty significant discount.

- Multi-car: A motorcycle policy combined with a policy on your car can get you a discount.

- Take a motorcycle safety course: Many insurers will offer a discount for passing a course.

- Join a group: Some carriers will lower your premiums, often by around 10%, if you're with an approved group such as the American Motorcycle Association, BMW Motorcycle Owners of America, Gold Wing Touring or Road Riders Association, Harley Owners Group, Honda Riders Club of America, Motorcycle Safety Foundation or Motorcycle Touring Association. You might get even more if you get involved with the group. For instance, GEICO offers up to 20% discounts for instructors with the Motorcycle Safety Foundation.

- Mention your safety equipment to your insurer: Some insurers will offer discounts if you can demonstrate that you have and wear a helmet and other safety features, such as an airbag in your motorcycle jacket.

Can I bundle home and motorcycle or get a multi-policy discount?

Yes, you can.

Bundling means you have multiple insurance policies with the same insurer. So, if you get motorcycle insurance with the insurance company that provides your homeowner's insurance, you may get a discount.

Still, it's essential to comparison shop. If you get 10% off with your current insurer, that doesn't help you if your policy would have been 20% lower with another insurance company.

The most frequent causes of motorcycle insurance claims

In 2023 (the latest data available), 6,335 motorcyclists were killed in motorcycle crashes, according to the National Highway Traffic Safety Administration (NHTSA). That accounted for 15% of all traffic fatalities. Another 82,564 motorcyclists were injured.

There are many situations that can lead to a rider's injury or death, some of which are preventable. Common causes of motorcycle insurance claims resulting from accidents are:

- Driving while impaired. "Driving under the influence of alcohol or drugs can cause accidents, and the driver may face both civil and criminal liability," Schrader says. According to the NHTSA, motorcycle riders involved in fatal crashes had higher percentages of alcohol impairment than drivers of any other motor vehicle type (26%) in 2023.

- Not wearing a helmet. In 2023, 35% of motorcycle fatalities were without a helmet.

- Car doors. Looking out for obstacles is important when riding a motorcycle, especially because auto drivers might not see you coming., "Accidents often occur when a car driver opens the door of their parked car in the path of an oncoming motorcycle," Schrader says.

- Speeding. "Speeding reduces the chance to react to other drivers or vehicles in time to prevent a collision," Schrader says. "The faster the speed, the higher the risk of an accident."

-- Geoff Williams contributed to this article.

FAQ: Motorcycle insurance

How much is motorcycle insurance in California?

According to data from Progressive, California is considered a high-cost state for motorcycle insurance. The average monthly price is $20.74, while the total 12-month policy average is $248.88 for a liability-only insurance policy with Progressive.

How much is motorcycle insurance for an 18-year-old?

Older, more experienced riders are less likely to get in accidents and file claims than younger riders. So, an 18-year-old should expect to pay quite a bit more for motorcycle insurance compared to someone older with a clean driving record.

Does motorcycle insurance cover passengers?

In general, there are three types of motorcycle insurance that will cover your passengers: personal injury protection, medical payments coverage and guest passenger liability coverage. Talk to your insurance agent about what types of coverage best fit your needs.