What to do if you hit a parked car

If you hit a parked car in a parking lot or on the street and can't find the owner, you have a legal duty to leave a note. State laws vary, but what happens if you hit a parked car and drive off is worse than filing an insurance claimAn insurance claim is a request you make to your insurance company for coverage after your car is damaged or you have an accident. You can file a claim online, by phone, or in writing., and may include fines and jail time.

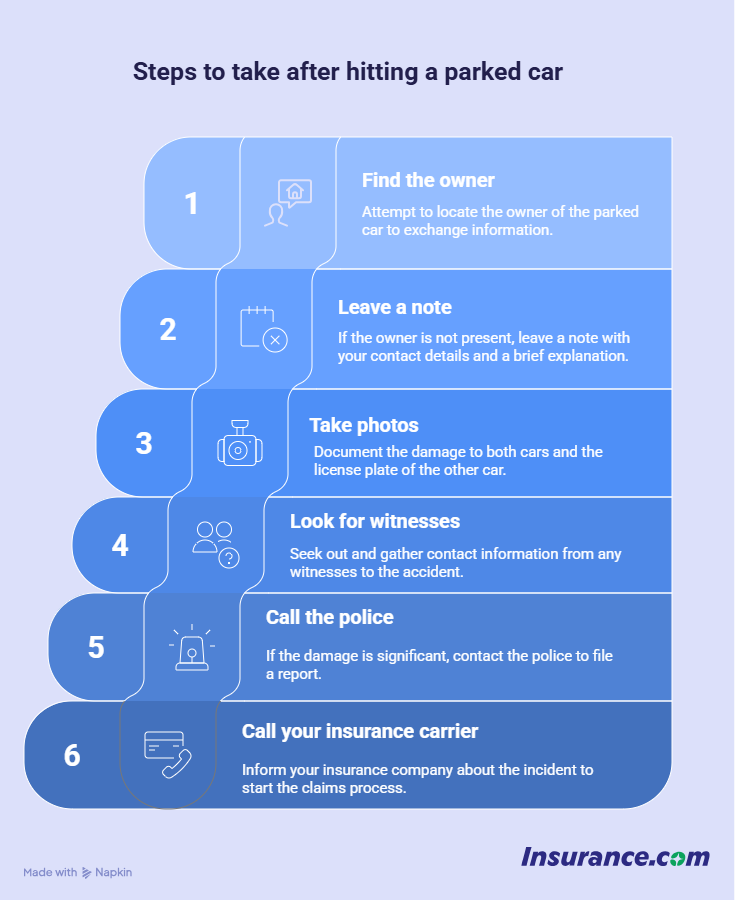

Here are the steps to take when you hit a parked car.

1. Attempt to find the owner

Never leave the scene of a parked car accident, even a minor one, without attempting to find the owner of the other vehicle. Hitting a parked car doesn't make you a criminal, but leaving the scene of an accident without leaving contact details is against the law in every state and can be considered a hit-and-run. What happens if you hit a car in a parking lot and leave?

The other driver will file a police report and an insurance claim, and you will likely be located.

“If the police have to hunt you down, you'll not only pay fines, but the other driver's insurance company might go after you for costs, including legal and investigative fees," says Stephanie Behnke, vice president of solutions and consulting at Hi Marley, an insurance communication and collaboration platform. "It can be a very expensive decision for the perpetrator and could lead to jail time. You're going to spend more money cleaning it up. Just financially, it doesn't make sense to leave."

2. Leave a note

If there's no one around, you should leave a note. "Nobody wants to [leave a note]," Siegel says. "Everyone's afraid."

But if you backed into a car or sideswiped it in the parking lot, do it anyway. Most states require that your note include this information:

- Name

- Address

- Contact number

- Explanation of what happened

If you were driving someone else’s vehicle when you hit a parked car, you must leave the name and address of the car’s owner as well. You can also include insurance company information. Keep the note simple, and don't admit fault.

3. Take photos

Take pictures of the damage to both cars and the license plate number of the other car.

Small "dings" can cost up to $1,000 to repair, so if there is visible damage, you’ll want to document that. You will also want to document what damage was there when you left so other damage can't be blamed on you.

4. Look for witnesses

Look for possible witnesses to the accident. Get their contact information and write down their description of what happened. Pass witness statements on to your insurance company and include them in the police report.

5. Call the police

If there is significant damage, you should call the police. Most states have laws that require a police report if the damage reaches a certain threshold. If you're not sure, it's best to call, Make sure to call the non-emergency line and not 911.

6. Call your insurance company

Behnke recommends reporting the incident to your insurance company as soon as possible so they can expedite the claims process, even if you don't have contact information for the other car's driver yet. If you left insurance information on the note, they may have contacted your insurance company directly.

Your property damage liability coverageAuto insurance coverage for losses that result when you damage or destroy someone else's personal property. This coverage is required in most states. will pay for the parked car’s damage and your collision coverage will cover your car after you pay your deductibleThe deductible is the amount you pay out of pocket for a covered loss when you file a claim..

What to do when someone hits your parked car

Now that we've covered what to do if you hit a parked car, we'll look at what to do in a hit-and-run parked car situation. What should you do if you find yourself in a situation where you walk to your car and find it dented or that your car has been sideswiped while parked? Parking lot hit-and-run accidents are common. Here are five steps to take when someone hits your parked car in a parking lot or on the street:

1. Collect information from the other driver if possible

If you witnessed the accident or the driver waited for you to arrive, collect the following information:

- Name

- Address

- Contact number

- Explanation of accident

- Insurance company

If you've been the victim of a hit-and-run on a parked car and the other driver is nowhere to be found, you will need to take additional steps listed below.

2. Check for witnesses

Whether you witnessed the accident or not, check the area for any potential witnesses. Collect their contact information in case the police and/or insurance company want to contact them during an investigation.

You may be able to obtain coverage of the accident from a nearby surveillance camera. Ask nearby businesses if they have footage.

3. Take photos and video

Take pictures of the damage to both cars and the license plate number of the other car. You’ll want to take photos of your vehicle before driving away. A video of the area surrounding the incident can also be helpful. Drivers are generally required to carry liability insurance, which covers accidents in which they are at fault, so document your damage.

4. Contact the police to report a hit-and-run

If someone has hit your car in a parking lot and left the scene, you should call the police. Remember that leaving the scene of an accident is a crime. Your insurance company will want a police report to open an insurance claim for a parked car accident, and the police can help you track down security footage and hopefully find the culprit.

5. Contact your insurance company

Even if you think the driver of another car is to blame and their insurance should pay, you should contact your insurance company. They will help you to navigate the claim and work with the other person's insurer. Your insurance company will also handle the claim in the event of a parking lot hit-and-run.

If you have collision coverageCollision coverage helps pay for repairs or replacement of your car if it's damaged in an accident, regardless of who is at fault and is subject to a deductible., can't find the other driver or are having difficulty with their insurer, your insurance company will pay for the damage. You’ll likely have to pay your deductible. If the other driver is uninsured, your uninsured motorist coverage may also kick in.

Even if it's a minor accident, don’t let the driver talk you into settling the issue yourselves without going through insurance. The person may renege, and your insurer will not pay for the damages if you report the accident weeks later.

Legal and insurance implications of parked car accidents

There are several legal concerns as well as insurance issues involved with parked car accidents. We've covered common ones below.

Whose insurance do I call if someone hits my parked car?

If you can exchange contact information and insurance details with the driver who hit your car, you'll file a claim with their insurance provider. If it's a hit-and-run, or if you have any concerns about the other driver being uninsured or arguments about fault, call your insurance company. It never hurts to call your insurer for advice.

Is it illegal to leave after hitting a parked car?

No, as long as you have tried to find the car's owner and, if you can't, have left a note. It is illegal to leave without doing these things, however.

It's usually a misdemeanor charge with a hefty fine if you're convicted. In some states, if you hit a parked car and leave the scene, you might serve jail time or be required to perform community service and police may suspend your license and/or registration.

"Getting into an accident is not a crime," says attorney Chip Siegel of Las Vegas, Nevada. "Leaving the accident is where the crime comes in."

People ask

I accidentally scratched someone's car and left, what should I do?

If you hit a car in a parking lot and left a scratch on the car, leaving the scene is wrong and illegal. Your best move is to return to the scene and see if the car is still there to leave a note.

If someone hits my parked car, do I have to pay a deductible?

If you file a claim with your insurance company for the damage, you will have to pay the deductible. Unless there is another driver whose insurance is paying for the damage, you'll have to use your coverage and therefore cover your deductible.

However, if the person who hit your car left a note and their insurance is covering the damage, you don't have to pay a deductible.

Will my insurance go up if I hit a parked car?

The insurance company will view it as an at-fault accident, regardless of whether you backed into a car in a parking lot or hit it with your door while getting out of your car. However, whether your rates increase depends on the insurance company’s surcharge schedule and what the state allows.

You can expect to see your rates rise if:

- The damage reaches the company’s chargeable accident threshold.

- You were ticketed in the accident.

- You’ve had multiple claims over a short time period.

The average car insurance rate increase for an at-fault accident nationwide is $1,607 a year. That amount varies by state, however, and you may see additional rate increases if you are convicted of any moving violations in relation to the accident, like speeding or reckless driving.

People ask

How much will my insurance go up after scratching someone's car?

If you have accidentally scratched someone's parked car and filed a claim with your insurance, your rates may go up in accordance with your insurer's policies for a minor claim. That will differ by insurer.

What to do if you hit a parked car and there's no damage

Even if there's no visible damage, you should still leave a note. There may be damage you aren't able to see that the owner notices later. If you hit a parked vehicle, regardless of whether you think you did any damage, you are legally required to leave your contact information. Take photos, even if you don't see any damage, of the part of both cars where contact was made.

How to avoid parked car accidents

There are a few things you can do to avoid both hitting another car and having damage done to your own car in a parking lot or on the street:

- Park away from other cars. Choose to park your car on the far end of the lot or on a less-packed side street, away from other cars.

- Don't try to park in a tight spot. Trying to fit into a spot that is hard to get your car into can result in hitting another car, or in your car being dinged when the car next to yours attempts to leave. Find a spot that fits your car with room on either side.

- Back up very slowly. Make sure you can see other cars around you and move slowly, especially in a packed parking lot.

- Get help if needed. If you're trying to park in or get out of a cramped space, ask a passenger to hop out and guide you if possible.

FAQ: Parked car accidents

How many points do you get for hitting a parked car?

You will not get points on your license just for hitting a parked car, as that's not illegal. However, a hit-and-run (leaving the scene of an accident) is illegal. The number of points assessed varies by state.

Will a hit-and-run claim raise my insurance?

It may. Any time you file a collision claim, your insurance could go up. You may lose a claim-free discount, affecting your rates, even if the accident was not your fault.

Does insurance go up if someone hits your parked car?

If you file a claim with your insurance to get the repairs covered because there is no other driver to cover it, then your premium may go up as a result.

What should I do immediately after hitting a parked car?

The first thing you should do after hitting a parked car is to try to find the owner. If you can't, document the damage and leave a note.