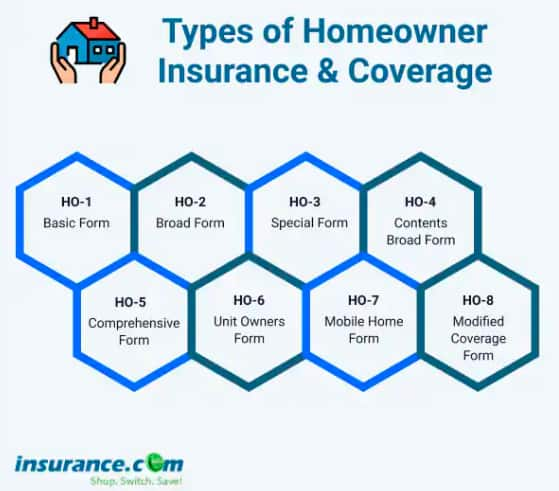

HO-1 - Basic Form

As you'd expect with something called "basic form," known in the industry as HO-1 - Basic Form, this is basic homeowners insurance. The insurance industry lists 16 types of perils (which we'll get to if you keep reading), and this type of insurance policy covers 10 of them.

- Damage from aircraft or vehicles

- Explosions

- Fire and lightning

- Hail and windstorms

- Riots

- Smoke

- Theft

- Vandalism

- Volcanic eruption

Basic form homeowners insurance doesn't include personal liability for those injured on your property, and your belongings aren't automatically covered.

Not surprisingly, many mortgage companies don't think HO-1 policies provide sufficient coverage. For these reasons, it isn't widely available or very commonly used.

HO-2 Broad Form

This type of home insurance policy typically covers all 16 perils. However, it's still a pretty fair policy with reasonable premiums. Here are the coverages provided by HO-2 that HO-1 does not include:

- Accidental discharge or overflow of water or steam from within a plumbing, heating, air conditioning, or automatic fire-protective sprinkler system or from a household appliance.

- Sudden and accidental tearing, cracking, burning, or bulging of a steam or hot water heating system, an air conditioning or automatic fire-protective system.

- Freezing of a plumbing, heating, air conditioning or automatic, fire-protective sprinkler system, or household appliance.

- Sudden and accidental damage from artificially generated electrical current (does not include loss to a tube, transistor or similar electronic component)

And the "Broad Form" isn't all that broad. The HO-2 is a "named peril" policy. Any damage caused by events other than those listed on your policy typically won't be covered.

HO-3 Special Form

This is the most common policy type and is the standard policy most homeowners buy.

It covers all disasters except those that are expressly excluded. That means you're protected against all perils unless your policy specifically mentions them in the exclusions. In addition to your home, the HO-3 insures attached structures, for example, a deck or garage and your belongings. It also includes personal liability coverage if you accidentally injure someone or damage their property. Still, HO-3s won't cover everything and what's not protected depends on your specific policy's details.

Here are some perils that are often excluded in HO-3 policies:

- Any animals owned by the insured

- Birds, rodents, vermin

- Defective construction or maintenance

- Earth movement

- Flood

- Foundation issues

- Government actions

- Intentional loss

- Mechanical breakdown

- Mold, fungus, wet rot

- Ordinance or law

- Pet or animal damage

- Pollution and corrosion

- Power failure

- Neglect

- Nuclear hazard

- Smog, rust, or corrosion

- Theft, vandalism and frozen pipes in vacant houses

- Wear and tear

- War

HO-4 Contents Broad Form

This is a renters insurance policy that covers your personal belongings against all 16 perils. It only covers your personal items and not the building since the landlord is responsible for insuring the dwelling.

HO-4 policies also provide liability insurance in case someone is injured in your apartment and provide money for living expenses should you need to stay elsewhere temporarily while the rental property is being repaired or renovated.

HO-5 Comprehensive Form

This is a more comprehensive version of the HO-3 form.

It's so comprehensive that it's typically only available to those who own a new, well-maintained home close to fire protection services.

Just like an HO-3 form, an HO-5 policy will financially protect you against all perils unless your policy expressly excludes them in writing.

The difference between an HO-3 and HO-5 is that HO-5 provides better protection for your personal belongings. An HO-5 insures your belongings against all causes of loss that are not explicitly excluded, whereas HO-3 only covers causes named on a specified list.

Here are some exclusions often listed in an HO-5 policy:

- Earth movement

- Government actions or laws

- An infestation of birds, rodents or insects

- Intentional loss

- Mechanical breakdown

- Mold

- Nuclear hazard

- Pets

- Vandalism if the property is vacant more than two months

- War

- Water damages from floods or sewer backup

HO-6 Unit-Owners Form

This is a condominium or co-op insurance policy similar to renters insurance. It covers the personal property of condo owners against all 16 perils and typically also includes liability insurance.

Generally, condo insurance will extend to the walls, ceilings and floors of your dwelling, though the condo association insures the building structure under a master insurance policy. The type of plan your condo association purchases will impact your HO-6 needs.

HO-7 Mobile Home Form

This is like an HO-3, except that an HO-7 covers mobile or manufactured homes. So, it covers all perils unless named explicitly as excluded and covers personal property based on named perils, including:

- Damage from aircraft or vehicles

- Explosions

- Explosions

- Fire and lightning

- Hail and windstorms

- Riots

- Smoke

- Theft

- Vandalism

HO-8 Modified Coverage Form

Are you hoping to buy a farmhouse built in the 1800s? You'll probably get an H0-8. This is an insurance policy designed for older homes.

The coverage details of an HO-8 are made with special adjustments to better suit older homes, and perils must be named in the policy to be covered.

This type of policy is usually also used for historic homes and registered landmark dwellings. Older homes are sometimes not eligible for replacement cost insurance, so the reimbursement for damages to possessions or the property would be based on the replacement cost minus depreciation.

Home insurance coverage levels

There are three main levels at which home insurance will pay out a claim. These apply to the dwelling coverage (coverage for the house) and to personal property coverage.

Actual cash value. Claims are paid based on the depreciated value, calculated based on the current replacement cost minus how much it's lost value over the years. Insurance companies take off a percentage of the value for each year of age. That means instead of being paid for a brand new TV, you'll get the replacement cost minus depreciation.

Replacement cost. With replacement cost coverage, you will receive the cost to replace everything new at today's prices. So even if your 10-year-old TV is stolen, you'll get enough to buy a new one.

Extended or guaranteed replacement cost. Adding extended replacement cost coverage to your policy offers additional protection if inflation renders you underinsured. It usually applies to a major damage claim where your policy's coverage limit might be exceeded. While extended replacement cost offers a percentage of additional coverage over the actual limit, guaranteed replacement cost extends the coverage as far as needed to cover the claim.

What is the difference between homeowners insurance policy types and homeowners insurance coverages?

The policy type will determine what coverages are included. So, there are multiple policy types, and within each type of policy is a list of coverages.

Standard homeowners insurance policies generally include:

Coverage A: Dwelling. Covers the structure itself, including the roof, siding, walls and windows.

Coverage B: Other structures. Covers any other structures on the property, like a detached garage, shed or fence.

Coverage C: Personal property. Covers everything in your house that you'd take with you if you moved.

Coverage D: Loss of use/Additional living expenses. Pays for additional living expenses if you can't live in your home during repairs from a covered loss.

Coverage E: Personal liability. Pays when you are responsible for injuries or damages to someone else.

Coverage F: Medical payments. Pays medical bills for someone injured on your property regardless of fault.

How to get homeowners insurance coverage for excluded perils

Even an all-perils homeowners insurance policy excludes some types of damage. For some of the excluded perils, you can purchase additional insurance, either as an endorsement or a separate policy.

Flood insurance coverage

Homeowners insurance policies don't cover floods, but you can buy flood insurance. Because floods can be so devastating to so many, the federal government sells flood insurance through its National Flood Insurance Program (NIFP). Some private insurers do sell flood insurance, but the policy rates will be the same as through the NIFP.

If you live in a flood zone, arguably, you should get flood insurance. If you don't live in one, then it's a judgment call.

Earthquake coverage

Earthquake coverage is another one of those judgment calls. More states than just California get earthquakes. You could have an earthquake rattle your house tomorrow - or never.

There is no federal program that sells earthquake insurance, but the California Earthquake Authority does offer a program to homeowners there.

Other endorsements

Some other exclusions can be covered with an endorsement. They include:

- Water and sewer backup

- Mold coverage

- High-value items

- Equipment breakdown

What type of home insurance do I need?

There are many types of property insurance, and which one you need depends on your living situation and the home itself. Most people have HO-3 standard home insurance, which provides comprehensive coverage for a single-family home.

If you own a condo, you need an HO-6 policy, while renters need HO-4 coverage. An HO-5 is a good choice if you have a high-value home or property you must protect. And HO-8 policies are best for older homes.

If you're unsure, talk to an insurance agent to pick the right policy.