- What is additional living expenses coverage?

- What does additional living expenses insurance cover?

- What isn't covered by additional living expenses?

- What makes a home uninhabitable for insurance purposes?

- How much additional living expenses coverage do you need?

- What are additional living expenses limits?

- How to calculate how much additional living expenses coverage you need

- How does an additional living expenses cash advance work?

- How to file additional living expenses coverage claims

- How long does additional living expenses coverage last?

- When can you claim your additional living expenses coverage?

- FAQ: Home insurance

What is additional living expenses coverage?

Additional living expenses (ALE) insurance is a standard part of a home insurance policy that reimburses you for extra expenses if you can’t live in your home due to a covered loss. For example, if a hurricane damages your home and makes it temporarily uninhabitable, ALE insurance will reimburse additional costs to stay at a hotel.

The amount you’re reimbursed is the difference between your everyday living expenses and these additional costs. For example, you might pay more for food if you eat at restaurants while waiting for repairs instead of your average grocery bill. You might have to move items from your home to a storage unit or pay to board your dog. ALE reimburses you for these extra unforeseen expenses, but there is a limit.

Many people don’t even realize they have additional living expenses as part of their homeowners or renters insurance policy, Walker says. But this coverage can come through for them when they need it most.

"Imagine being forced out of your home on a moment's notice due to an evacuation order, water damage or fire," she says. "Could you afford to temporarily live elsewhere with the understanding that you are still responsible for your mortgage, utilities and other household expenses?"

ALE is also typically included in condominium owners and renters insurance policies, but you should always check your policy's terms.

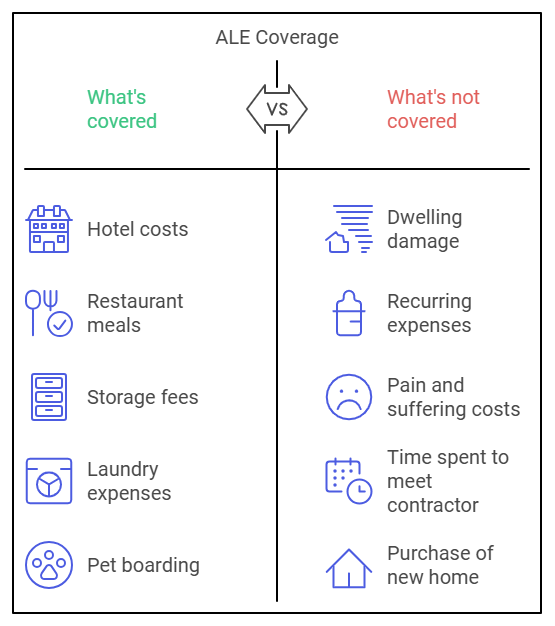

What does additional living expenses insurance cover?

ALE on homeowners policies covers a hotel stay and costs you incur while your home is uninhabitable and is being repaired or rebuilt after a covered loss. The coverage to keep a temporary home is meant to maintain your standard of living.

Covered costs include those that exceed your everyday living expenses. ALE might reimburse you for things such as:

- Hotel or temporary rental costs

- Restaurant meals

- Storage fees

- Laundry

- Boarding a pet

- Mileage

ALE often covers lost rental income, too, like if you lost money after a covered disaster because you could no longer rent a room to a tenant.

People ask

Does homeowners insurance cover temporary housing?

Yes, homeowners insurance policies cover temporary accommodation if your home is uninhabitable due to a covered loss.

What isn't covered by additional living expenses?

ALE does not cover any costs that are part of your regular expenses, such as utility bills or groceries. There are also limits to how much you can spend on those expenses. ALE doesn't pay for a room at the Four Seasons; it pays for what you need to get by and only for the difference in your temporary and usual costs.

"ALE is designed to pay for out-of-pocket expenses and temporary housing similar to your current home," Walker says. "In other words, ALE will not pay for a five-star hotel or expensive dining tabs that aren't equal to your normal day-to-day expenses."

ALE doesn’t cover:

- Damage to your dwelling

- Recurring expenses you were already paying, like childcare

- Costs due to pain and suffering

- Time spent meeting with contractors, insurance adjustors, or other meetings

- Purchase of another home or other dwelling, like an RV or trailer

Additionally, ALE might not cover some events, like floods or earthquakes. Check with your policy about what events are covered; you may need an endorsement or separate policy.

People ask

Does homeowners insurance cover temporary housing?

Yes, homeowners insurance policies cover temporary accommodation if your home is uninhabitable due to a covered loss.

What makes a home uninhabitable for insurance purposes?

A home is uninhabitable if it's unsafe to live in or damaged to the point where you can't perform everyday tasks. Your insurance adjuster will determine if the damage is severe enough for your ALE benefits to kick in. If possible, discuss it with your adjuster before you check into a hotel.

How much additional living expenses coverage do you need?

Your additional living expenses coverage limit is typically a percentage of your homeowners insurance dwelling coverage.

Standard ALE coverage is 20% of the dwelling coverage. That means if you have $200,000 of dwelling coverage, your additional living expenses coverage limits would be $40,000. You may be able to increase this amount.

Typically, additional living expense coverage will reimburse you for any costs related to a peril covered by your insurance policy that damages your home.

"This money is designed to cover extra out-of-pocket expenses for hotels or temporary housing, car rentals and other expenses you may incur while your home is being repaired," Walker says.

Let's look at a specific example of how ALE works, using a homeowner we'll call Elijah, who has the policy limits listed above. There has been a fire at Elijah's home, and he, along with his spouse, two children and the family dog, can't live there during repairs. They incur the following costs:

- The family stays at an extended-stay hotel, which costs $300 a night. They live in this hotel for 21 days. Total cost: $6,300.

- The hotel isn't pet-friendly, so the family has to board the dog at a cost of $40 a night. Total cost: $840.

- The hotel room doesn't have a full kitchen, so the family must eat out at night, which costs an average of $150 a day. Total cost: $3,150.

- The hotel is further from work and school, costing the family an additional $50 a week in gas. Total cost: $150.

Total cost for three weeks: $10,440.

Elijah's additional living expense limit is $40,000, so there's enough to cover it. However, the insurance company will only cover the difference between what the family has to pay to live elsewhere and what they normally pay. For example:

- The family's normal grocery budget is $500 a week. They're at the hotel for three weeks, spending $1,650 more on food because they are eating out. ALE will cover that difference.

- ALE will only cover the difference between the usual commuting costs and the ones from the hotel.

Total eligible expenses for ALE: $8,940.

Walker says that while home insurance policies typically include up to 12 months of additional living expenses, some offer up to 24 months as either part of the policy or as a purchase option.

Longer coverage can be valuable in some situations. "If you live in a high-risk wildfire or catastrophe area, it's important to consider it may take a longer amount of time to repair or rebuild your home after a disaster," Walker says.

What are additional living expenses limits?

Your ALE limits are usually a standard percentage of the main coverage on your policy. The type of policy you have will determine that percentage.

These limits may vary by company, but here are some averages:

- For a homeowners insurance policy (HO-2, HO-3, HO-5): 20-30% of dwelling coverage.

- For a specialty homeowners policy (HO-8): 10% of dwelling coverage.

- For a condo insurance policy (HO-6): 50% of the personal property coverage.

- For a renters insurance policy 9HO-4): 40% of the personal property coverage.

You can often increase these limits for an extra cost.

How to calculate how much additional living expenses coverage you need

To determine how much coverage you need, break down the categories of expenses you need covered, such as:

- Housing

- Utilities

- Meals

- Transportation

- Miscellaneous, including things such as laundry costs

Individual expenses would be listed under each of these general categories. For example, under the "utilities" category, you might include individual entries for everything from gas and water to internet and cable TV costs.

You would note the cost and the additional expense you incurred for each. And, remember that ALE doesn't cover your already existing regular expenses, so you need to subtract that amount.

The equation would look like:

Total additional living expenses - Normal living expenses = ALE claim amount

If your living expenses while your home was uninhabitable for three months were $12,000, and your everyday living expenses for three months were $8,500, your ALE claim would be $3,500. However, how much will be paid depends on your policy limits.

How does an additional living expenses cash advance work?

Unless you have a lot of savings, you might need a cash advance from your insurance company to pay your bills. But getting such a check via your additional living expenses coverage isn’t always easy.

"Many insurers will give payment advances, but it's patchy," says Amy Bach, executive director of United Policyholders. How do you get additional living expenses to cash out? "You need to ask for it, and if the adjuster says no, you need to push a little more and go up the chain."

Fortunately, insurance companies generally reimburse for expenses as they are incurred, so you don't have to wait to receive a lump-sum check at the end of the process.

Keep meticulous records of every expenditure and save all your receipts in a waterproof, zippered pouch.

"Without receipts, you don't get payment," Bach says.

How to file additional living expenses coverage claims

Here’s how to file an ALE claim if you experience a disaster or other covered event:

Call your insurance company.

If your home is damaged to the point where you can no longer live in it, call your insurance company promptly.

"One of your first calls after evacuating or suffering a loss must be to your insurance carrier," Walker says.

Document your discussions—from the first time you call your insurance company to verify your ALE coverage. Grab a notebook or your notes app – jot down who you talked to, the date, the time, and the details you discussed. Documentation is critical to a smooth claim process.

Follow your insurer's instructions.

An agent or representative will help you better understand what your insurance covers under ALE and the step-by-step process for filing your claim.

Your insurer can also help you find temporary housing and explain the reimbursement options available to you.

Closely follow the policies and procedures your insurer has put into place for making a claim. Doing so can help prevent unnecessary difficulties in getting your reimbursement.

"ALE is typically a separate insurance check from your home repair or personal contents claim payment," Walker says.

Keep receipts

In most cases, the only way to get reimbursed through ALE is by keeping receipts. You must prove to your insurer that you incurred more expenses due to being dislocated than you would typically pay to live in your house.

File the claim

Following your insurer's instructions, submit the claim and any receipts showing you had additional expenses because you weren't living in your normal dwelling.

How long does additional living expenses coverage last?

ALE coverage lasts until your home is repaired and you are able to move back in. However, some states have laws regarding how long insurance companies must provide ALE coverage, generally in the case of a major catastrophe where a state of emergency is declared.

ALE is limited more by the available coverage than by the timeline of repairs.

When can you claim your additional living expenses coverage?

ALE claims can only be filed when forced from your home due to a covered peril or evacuation order. You can't file a claim if you move out while renovations are being done voluntarily, nor will it pay if the damage is due to an excluded peril like flooding. You also probably can't file an ALE claim for a vacant house when an event happened, like if a hurricane damaged a vacation home in the off-season.

FAQ: Home insurance

Does homeowners insurance cover evacuation costs?

Homeowners insurance will cover additional living expenses you incur when you are evacuated from your home.

Can you get loss of use reimbursement from an insurance company when staying with a friend or relative?

Yes, it’s possible to get loss-of-use reimbursement when staying with a friend or relative. Walker says some costs may still be reimbursed so long as you have been forced to live elsewhere due to a covered loss.

"Staying with friends or relatives may help you save on expenses that may not be covered," Walker says.

Does renters insurance cover temporary housing?

Yes, a renters insurance policy includes ALE coverage that works similarly to homeowners and will pay for a place to stay if you can't live in your rental home due to a covered loss.

Will homeowners insurance cover a hotel stay?

Under ALE coverage, most homeowners insurance policies will cover the cost of a hotel stay if your home is uninhabitable due to a covered event, such as a fire or severe weather. However, coverage varies from policy to policy.

Generally speaking, your homeowners insurance will pay for temporary housing up to the limit specified in your policy for additional living expenses. This coverage is typically a percentage of the dwelling coverage amount on your policy, usually between 10% and 20%.