Gap insurance vs. loan or lease payoff

Both gap insurance and lease/loan insurance help to cover the difference between your vehicle's cash value and the amount you still owe on its loan or leasein the event of a total loss. The main difference between the two insurance types is that lease/loan coverage generally stipulates a limit on what benefits are available, generally as a percentage of your vehicle's value.

According to insurance company Esurance, lease/loan insurance often pays about 25% of your vehicle's actual cash valueActual Cash Value (ACV) is the current market value of your car, considering depreciation. It's the amount your insurance will pay if your car is totaled or stolen.. Depending upon where you are in your loan repayment process and how that compares to your vehicle's cash value, this may or may not be enough to cover your remaining loan or lease value in the event of a complete loss.

For example, if your car is worth $25,000 and your lease/loan coverage pays up to 25% of your vehicle's worth, the maximum payout in the event of a total loss would be $6,250. During the early part of your loan, this coverage amount may not provide complete protection.

Gap insurance vs. new car replacement

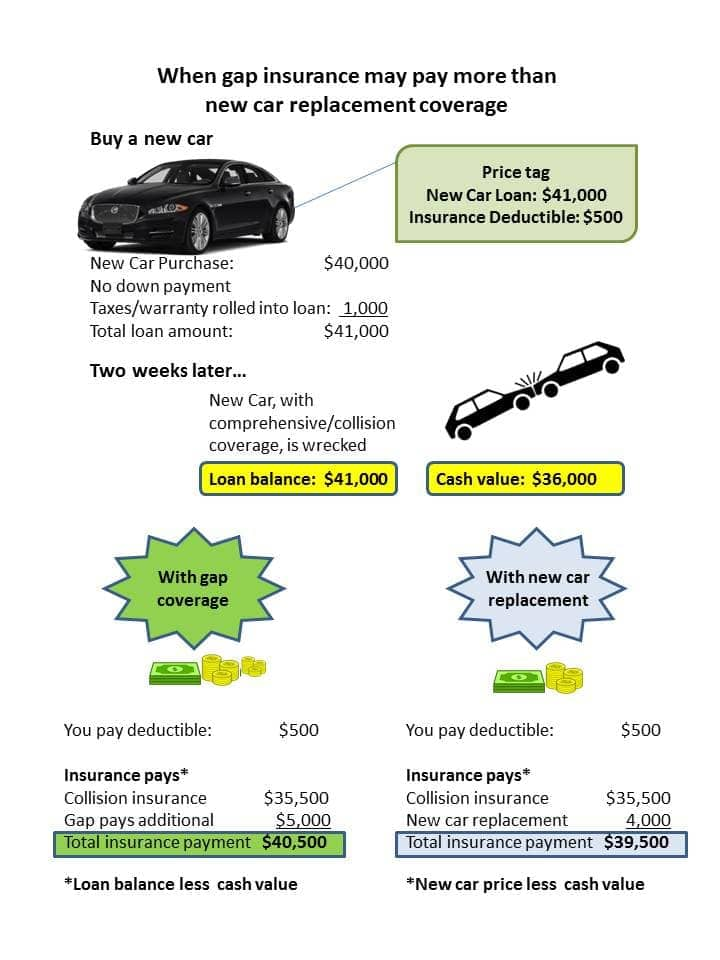

Gap insurance coverage is designed to protect you if your car is a total loss by making up the difference between the auto loan balance and the car's cash value.

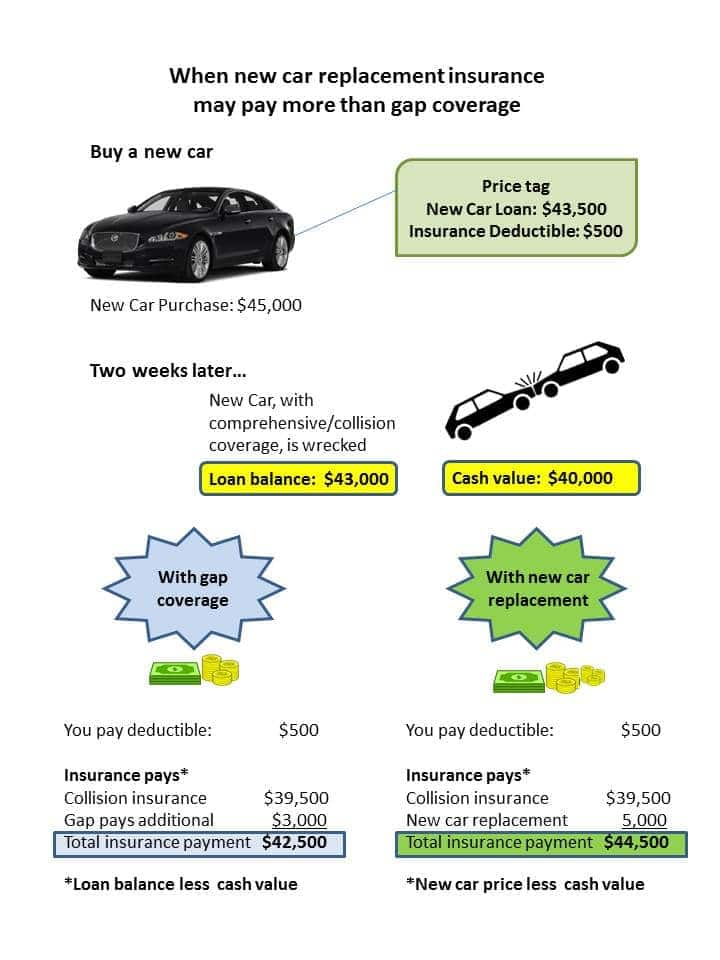

New car replacement coverage is different. It covers the difference between the car's cash value and the cost of purchasing that exact car again new. When you drive a new car off the lot, it officially becomes a "used" car and loses value immediately. If you total your new car on your way home from the dealership, the car's cash value would be less than the cost of replacing it. Replacement coverage would make up the difference, allowing you to buy another car exactly like the one you totaled.

However, this has nothing to do with your loan amount. If your loan balance exceeds the car's replacement value, you'll still have to pay your lender unless you have gap insurance. The illustration below shows what happens when you total your car with gap insurance.

If the cost to replace your car is higher than your loan balance, it may be best to have new car replacement coverage. The illustration below differs from the one above in that the replacement costThe cost of replacing or repairing lost or damaged property with like kind and quality at today’s price without depreciation. is higher than the loan balance.

The comparison between gap and new car replacement depends on the loan balance and the car's depreciationDepreciation is the decrease in your car's value over time due to wear and tear, age and mileage. Depreciation is used to determine the actual cash value of a vehicle in the event of a total loss. rate. If your loan amount exceeds the car's purchase price, gap insurance should pay more. If the loan is less than the car's replacement price, new car replacement may pay more.