What parts of homeowners insurance are tax-deductible?

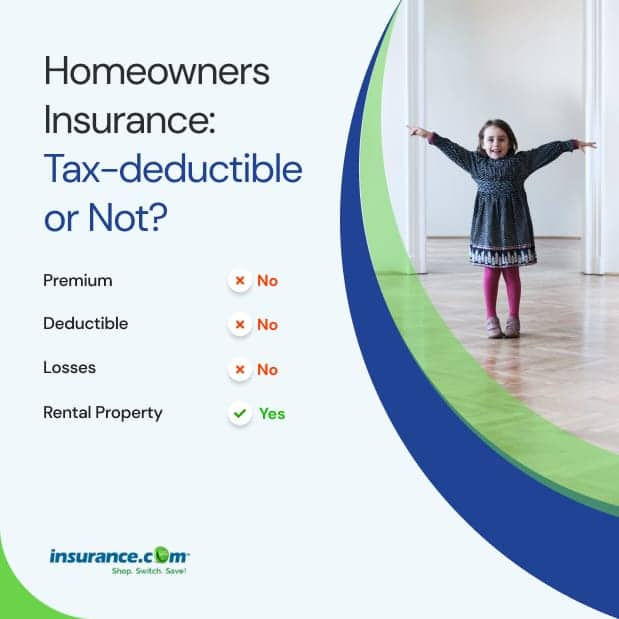

For most people, homeowners insurance is not a tax deduction. This includes your premiums as well as your deductible, if you paid it this year.

If the home in question is a rental property or even if you rent out a portion of your primary residence regularly, you may be able to deduct a portion of your homeowner insurance premium. It may also be possible to deduct some of your homeowner's insurance premium if you have a home office and run a business out of your home.

Let’s have a quick look at possible tax deductions when it comes to homeowners insurance.

Are home insurance premiums tax-deductible?

In most cases, the answer to this question is no. Regardless of whether you pay an above average premium or your rates fall on the cheap side of the scale, your homeowner's insurance premium is not deductible on your state or federal taxes. This not only includes your premium but your deductible as well as any property losses you incur.

However, there are some circumstances that allow you to deduct a portion of your home insurance premium. If you work from home, use part of your home as a business or rent out the house, you should be able to deduct some of your insurance costs.

“If you are self-employed (e.g. you have your own business or have 1099 income) you may be entitled to a home office deduction if you have dedicated space in your home where you regularly and exclusively conduct your business,” says Logan Allec, a CPA and founder of personal finance site Money Done Right.

You may also be able to take a deduction for any losses or damage your home suffered that were not fully covered or reimbursed by your insurer. This is relatively common with earthquake and flood losses. However, you have to meet very specific criteria, which we will examine in a bit.

Is my home insurance deductible tax deductible?

The short answer is no, but as with most tax-related issues, there is an exception. If you suffer a loss in an area that is declared a national disaster area and your insurer denies your insurance claim or only partially pays your claim, you can deduct the unpaid balance, including your insurance deductible, from your taxes.

With this deduction, you must also subtract $100 and 10% of your adjusted gross income (AGI) from the loss amount and then whatever amount is left over can be deducted. Unless you suffered a large loss that your insurance wasn’t covered, this deduction will probably not be that useful.

Can I deduct homeowners insurance losses from my taxes?

This one gets a bit complicated. While you cannot deduct insurance losses that your insurer covered, if your insurer denied your claim or only partially paid the claim, you may be able to deduct the loss.

However, thanks to a tax law change back in 2017 (The Tax Cuts and Jobs Act of 2017), you can only deduct a casualty loss if the property loss occurred in a federally declared disaster area. This means that your loss must occur in an area that the President has declared a disaster, making the area eligible for federal relief or assistance.

Making things even more complicated is that you must subtract $100 per incident and 10% of your adjusted gross income from the loss amount. The amount left after all of this can be deducted from your taxes.

Let’s look at a couple of examples to make this all a bit clearer:

- Insurance company pays your claim: Your roof is blown off during a major storm, the damage is assessed at $15,000. Your insurer pays your claim in full minus your deductible. None of this can be deducted from your taxes. Since your insurer paid the claim in full, none of the loss, including your insurance deductible, is tax-deductible.

- Insurance company pays partial claim: Your roof is blown off during a major storm. While it was a big storm, the area was not declared a federal disaster area. The damage is assessed at $15,000, but your insurer only covers $5,000. Because the damage did not occur in a federally declared disaster area, you cannot deduct any of the $10,000 that your insurer failed to cover.

If the area was declared a federal disaster area, you could then deduct $$9,900 ($10,000 minus $100) minus 10% of your AGI. Whatever is leftover can be deducted from your taxes. In this case, you can even deduct your insurance deductible.

It should be noted that you cannot deduct the cost of home improvements that exceed the repair cost. For example, if your barn is destroyed and your claim is denied, you can deduct the barn's value (as long as you are in a federally declared disaster area), but you cannot replace it with a larger barn and deduct the full cost. Your deduction would be capped at the value of the destroyed barn.

Is homeowners insurance tax deductible for a rental property?

If you have a rental property or rent out your primary residence from time to time, you may be able to deduct your insurance costs from your taxes. Renting a home is considered work, so the income is taxable, which makes expenses for that property a business expense that can be deducted.

According to the IRS, “You can deduct the ordinary and necessary expenses for managing, conserving and maintaining your rental property. Ordinary expenses are those that are common and generally accepted in the business. Necessary expenses are those that are deemed appropriate, such as interest, taxes, advertising, maintenance, utilities and insurance.”

When it comes time to file your taxes, you will need to file a Schedule E (Supplemental Income and Loss) form to document your rental income and expenses related to that rental.

Are home improvements tax deductible?

If you are gutting your kitchen or adding a deck on the back of your home, don’t expect a tax break. The federal tax code does not allow a deduction for home improvements. However, home improvements do often increase the value of your home, which can be recognized when you sell the home so it is important to keep the details and receipts of all home improvements.

“When it comes time to sell your home, all these home improvements can increase the basis of your property and thus reduce your potential for paying capital gains on the sale of your home.

For example, if you paid $250,000 for your home and added a swimming pool for $50,000, your new basis might be $300,000. If you sell your home for $800,000 as a married couple filing jointly, this $500,000 difference would not be taxed. Without the home improvement, you would have paid capital gains on that $50,000 of non-excluded appreciation,” says Riley Adams, a CPA and founder of the personal finance site Young and the Invested.

In this example, it is important to note that the same scenario would have been different for a single filer or married couple filing separately, who can exclude up to $250,000 in capital gains. A married couple filing jointly can exclude up to $500,000. Both must have lived in the home for two out of five years to be eligible.

However, aside from increasing the home value to benefit at the time of sale, there are a couple of tax deductions available for particular improvements.

Energy-efficient improvements

Energy-efficient equipment such as solar panels, geothermal heat pumps, solar water heaters, wind turbines and even fuel cells can be eligible for a tax credit. According to the Renewable Energy Tax Credit, the IRS says "energy-saving improvements" made to a personal residence before January 1, 2021, qualify for a tax credit. The credit is equal to 26% of the cost of the installed equipment.

This tax credit can be applied to your primary home or a vacation home. A tax credit is simply a dollar-for-dollar reduction of your tax bill. For example, if you installed a $50,000 solar panel system, you should receive a tax credit of $13,000 (26% of $50,000) that can be applied to your taxes.

A tax credit can be refundable, which means if the credit zeros out your tax bill, you would receive the balance as a refund. Unfortunately, this particular tax credit is not refundable, so once your tax bill goes to zero, the rest of the credit is lost.

Medical renovations

There can be a tax deduction for home improvements related to medical issues, but only if you meet a specific threshold. The IRS allows a deduction for medical expenses related to "the diagnosis, cure, mitigation, treatment, or prevention of disease.”

You can only take this deduction after your costs have exceeded 7.5% of your adjusted gross income, so this deduction is probably not helpful unless you have to make some significant renovations to your home.

However, if you have to make significant changes to your home, such as adding ramps, widening hallways, adding lifts and modifying bathrooms, those costs could quickly meet the AGI threshold.

How does tax deduction work if you are working from home?

If you run a business out of your home, you may be able to take a deduction for your home office. The amount you are eligible to deduct is based on your office's square footage in relation to the square footage of your home.

As an example, if your home office takes up roughly 12% of your home’s total square footage, you can deduct 12% of your homeowner's insurance premium.

There are qualifiers though, the space must be used as an office most of the time and must be in a specified area of the home; you cannot claim every desk and chair in the house as an office. Your office can be located just about anywhere on the property, though. If you have an outbuilding that operates as an office or a room above your garage that works as an office, you can claim the deduction.

The verdict: Is homeowners insurance tax-deductible?

For the vast majority of people, the answer to this question is a resounding no. If your home is your primary residence, you live in it full time and do not have a home office, you cannot deduct your home insurance costs.

However, there are exceptions, and if you meet the qualifications, you can deduct some of your homeowner insurance costs. Here is a quick recap of the various deduction’s homeowners may qualify for:

- Medical: If you have to modify your home for medical reasons (ramps, remodel bathrooms, etc.) you may be able to deduct those costs, but the costs must exceed 7.5% of your adjusted gross income.

- Home office: If you run a business out of your home, you may be able to deduct a percentage of your homeowner’s insurance cost.

- Rental property: If you own a rental property or rent out your primary residence (or part of it) from time to time, you may be able to deduct your expenses, including homeowners insurance costs.

- Energy-efficient: Putting solar panels on your home or adding other energy-efficient features can result in a tax credit.

- Losses: If your insurer denies your claim or only covers a portion of it, you may be able to write off the loss, but there are strict requirements that must be met.

The content of this article is not tax or legal advice and should not be considered a substitute for professional tax or legal advice. For current tax or legal advice that is relevant to your state, please consult with an accountant or a licensed attorney.