- How much is home insurance in Texas?

- How much is home insurance in Texas per month?

- Best home insurance companies in Texas

- Cheapest home insurance in Texas

- Texas home insurance trends

- Texas home insurance calculator: Rates by ZIP code

- Average homeowners insurance in Texas by coverage level

- Texas homeowners insurance rates by county

- Average home insurance rates in Texas' largest cities

- How to lower homeowners insurance rates in Texas

- Methodology

- FAQ: Texas home insurance

- Compare Texas homeowners insurance rates with other states

How much is home insurance in Texas?

The average cost of home insurance in Texas is $3,851 a year, making Texas the fifth most expensive state in the country for homeowners insurance. The average Texas homeowners insurance rates are $1,250 more than the national average home insurance rate of $2,601 for insurance coverage of:

- $300,000 dwelling coverage

- $1,000 deductible

- $300,000 liability

- 2% hurricane deductible

Texas home insurance rates have increased by 54.4% from 2019 to 2024, per S&P Global. The increase in premiums makes shopping around vital.

How much is home insurance in Texas per month?

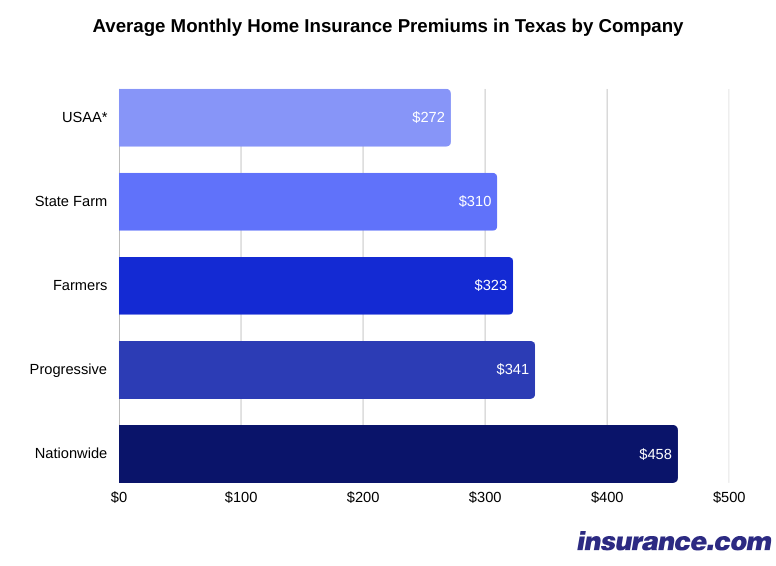

The average home insurance cost in Texas is $321 per month for $300,000 in dwelling coverage with a $1,000 deductible and $300,000 of liability protection. State Farm has the cheapest home insurance in Texas at an average of $310 a month.

The table below shows the average monthly Texas home insurance rates for various coverage limits. State Farm has the cheapest home insurance in Texas at an average of $310 a month.

| Company | Monthly premium |

|---|---|

| State Farm | $310 |

| Farmers | $323 |

| Progressive | $341 |

| Nationwide | $458 |

| USAA* | $272 |

*USAA offers insurance only to military members, veterans and their families.

Best home insurance companies in Texas

Based on our analysis, State Farm is the top home insurance company in Texas. It’s followed by Farmers and Progressive.

We pulled out a few top companies in specific categories to make your choice easier. These are based on third-party ratings and our Best Home Insurance Companies survey for 2025.

- Best for cheap rates: State Farm ($3,725 annually)

- Best for having a low complaint volume: Farmers ($3,872 annually)

- Best for financial stability: State Farm ($3,725 annually)

Affordable home insurance in Texas can be hard to find, but it's important to look beyond a cheap rate when you're shopping. You need an insurance company that will be there when you need it.

We chose the best home insurance companies in Texas based on:

- AM Best financial stability ratings, which indicates a company's ability to meet it's financial obligations, like paying claims

- Average rates for a home insurance policy with $300,000 in dwelling coverage

- NAIC complaint index ratio, which measures the number of complaints a company receives against its market share

Take a look at the full ranking of home insurance companies in Texas below.

*USAA insurance is only available to military members, veterans and their families.

Progressive

Progressive is the best home insurance company in Texas among the top companies we analyzed. It has a strong A+ rating from AM Best and a low complaint ratio. Rates aren’t the cheapest but are lower than some big competitors.

State Farm

The biggest name in home insurance nationwide, State Farm is our No. 2 pick for home insurance in Texas. It boasts the highest possible AM Best rating and the cheapest rates among top companies that were ranked.

Farmers

Farmers came in third for home insurance in Texas with a low complaint ratio with the NAIC and a solid rating with AM Best. Its rates are not the lowest among the companies we compared, but it’s solid reputation ranks it highly.

People ask

Which insurance company is best for customer satisfaction in Texas?

Progressive has the lowest NAIC complaint ratio of any of the companies we ranked for home insurance in Texas.

Cheapest home insurance in Texas

The following home insurance rates are categorized by company for six coverage sets. Based on our rate analysis, State Farm has the best homeowners insurance rates in Texas at most coverage levels. Farmers is a little lower at the $200,000 dwelling coverage level. USAA is cheaper than both if you qualify.

The following home insurance rates are categorized by company for six coverage sets.

- Cheapest for $200,000: Farmers at $2,842

- Cheapest for $300,000: State Farm at $3,725

- Cheapest for $400,000: State Farm at $4,482

- Cheapest for $600,000: State Farm at $6,300

- Cheapest for $600,000: State Farm at $9,436

Six different dwelling coverages are shown, with a $300,000 liability limit and a $1,000 deductible.

| Company | $200,000 | $300,000 | $400,000 | $600,000 | $1,000,000 |

|---|---|---|---|---|---|

| Farmers | $2,842 | $3,872 | $4,871 | $6,954 | $10,832 |

| Nationwide | $4,190 | $5,495 | $6,730 | $10,244 | $15,563 |

| Progressive | $3,398 | $4,095 | $4,959 | $7,460 | $11,953 |

| State Farm | $3,020 | $3,725 | $4,482 | $6,300 | $9,436 |

| USAA | $2,478 | $3,263 | $3,998 | $5,465 | $8,273 |

Texas home insurance trends

What’s affecting home insurance in Texas? Here’s what you need to know.

- Texas insurer New Century Insurance has been declared insolvent, with all policies to be canceled by October 3, 2025, Insurance Business reports.

- Texas is facing a perfect storm of factors that will cause insurance rates to rise, Cotality reports. No state has seen more billion-dollar disasters in this decade than Texas.

- Home insurance companies are using drones to inspect homes, NPR reports, leading to nonrenewals and complaints from customers.

- Bill 213, which makes it illegal for insurance companies to force home insurance customers to bundle auto insurance with the same company as a condition of renewal was enacted by the Senate.

Texas home insurance calculator: Rates by ZIP code

ZIP code 77586 in El Lago is among the most expensive places to insure a home in Texas at an average of $14,025. That’s over $12,000 more than in El Paso ZIP code 79905, the cheapest ZIP code in the state for home insurance.

By entering your ZIP code in the homeowners insurance calculator below, you’ll see the average home insurance rate for that area and the highest and lowest premiums fielded from major insurers. This will give you an idea of how much you can save by shopping around for coverage.

Rates are for coverage of $300,000 with a $1,000 deductible and $300,000 liability limits.

Home insurance calculator by ZIP code

Average home insurance rates in TexasMost & least expensive ZIP codes for homeowners insurance in Texas

| ZIP code | City | Highest rate |

|---|---|---|

| 77550 | Galveston | $10,164 |

| 77586 | El Lago | $9,906 |

| 77551 | Galveston | $9,536 |

| 77554 | Galveston | $9,358 |

| ZIP code | City | Lowest rate |

|---|---|---|

| 78559 | Iglesia Antigua | $1,956 |

| 78593 | Santa Rosa | $1,999 |

| 79915 | El Paso | $2,008 |

| 79905 | El Paso | $2,009 |

The Texas Department of Insurance says...

Someone from the insurance company may inspect the outside of your house when you apply for insurance. The company you chose with the best policy and price might not want to sell you insurance if your house is in bad shape.

To improve your home's safety and appearance:

- Replace rotting boards, sagging screens, and other damage.

- Fix cracks in walkways, loose railings, uneven steps, and things that could cause accidents.

- Replace a damaged or worn roof.

- Keep your yard clean and trimmed.

- Remove tree limbs hanging over your house.

- Touch up paint that is peeling or faded.

Average homeowners insurance in Texas by coverage level

We base our sample rates on a policy with $300,000 in dwelling coverage and liability and a $1,000 deductible to provide a middle-of-the-road average. Your dwelling coverage needs depend on the replacement cost of your home.

Here is the annual average home insurance cost in Texas for dwelling coverage levels of $200,000 to $600,000 with a $1,000 deductible and liability coverage of $100,000 and $300,000.

| Coverage level | Average annual rate | Average cost per month |

|---|---|---|

| $200,000 dwelling with $100,000 liability | $2,944 | $245 |

| $200,000 dwelling with $300,000 liability | $2,951 | $246 |

| $300,000 dwelling with $100,000 liability | $3,844 | $320 |

| $300,000 dwelling with $300,000 liability | $3,851 | $321 |

| $400,000 dwelling with $100,000 liability | $4,736 | $395 |

| $400,000 dwelling with $300,000 liability | $4,744 | $395 |

| $600,000 dwelling with $100,000 liability | $6,794 | $566 |

| $600,000 dwelling with $300,000 liability | $6,804 | $567 |

| $1,000,000 dwelling with $100,000 liability | $10,459 | $872 |

| $1,000,000 dwelling with $300,000 liability | $10,469 | $872 |

Texas homeowners insurance rates by county

The cost of homeowners insurance in Texas varies by county. Find your county below to see how rates in your area compare to the state average.

| County | Average annual premium | Average monthly premium |

|---|---|---|

| Anderson | $3,461 | $288 |

| Andrews | $3,291 | $274 |

| Angelina | $3,163 | $264 |

| Aransas | $5,294 | $441 |

| Archer | $4,536 | $378 |

| Armstrong | $4,388 | $366 |

| Atascosa | $2,870 | $239 |

| Austin | $4,409 | $367 |

| Bailey | $4,045 | $337 |

| Bandera | $2,759 | $230 |

| Bastrop | $2,800 | $233 |

| Baylor | $4,460 | $372 |

| Bee | $4,467 | $372 |

| Bell | $2,823 | $235 |

| Bexar | $2,745 | $229 |

| Blanco | $2,764 | $230 |

| Borden | $3,662 | $305 |

| Bosque | $3,678 | $306 |

| Bowie | $3,439 | $287 |

| Brazoria | $4,898 | $408 |

| Brazos | $3,059 | $255 |

| Brewster | $2,358 | $196 |

| Briscoe | $4,299 | $358 |

| Brooks | $3,678 | $306 |

| Brown | $3,935 | $328 |

| Burleson | $3,316 | $276 |

| Burnet | $2,789 | $232 |

| Caldwell | $2,801 | $233 |

| Calhoun | $4,749 | $396 |

| Callahan | $4,120 | $343 |

| Cameron | $3,468 | $289 |

| Camp | $3,436 | $286 |

| Carson | $4,165 | $347 |

| Cass | $3,521 | $293 |

| Castro | $3,857 | $321 |

| Chambers | $4,790 | $399 |

| Cherokee | $3,351 | $279 |

| Childress | $4,457 | $371 |

| Clay | $4,551 | $379 |

| Cochran | $4,037 | $336 |

| Coke | $3,902 | $325 |

| Coleman | $4,006 | $334 |

| Collin | $4,077 | $340 |

| Collingsworth | $4,597 | $383 |

| Colorado | $4,067 | $339 |

| Comal | $2,764 | $230 |

| Comanche | $4,060 | $338 |

| Concho | $3,791 | $316 |

| Cooke | $4,254 | $354 |

| Coryell | $3,047 | $254 |

| Cottle | $4,457 | $371 |

| Crane | $3,160 | $263 |

| Crockett | $2,929 | $244 |

| Crosby | $3,947 | $329 |

| Culberson | $2,153 | $179 |

| Dallam | $3,778 | $315 |

| Dallas | $4,145 | $345 |

| Dawson | $3,850 | $321 |

| Deaf Smith | $4,245 | $354 |

| Delta | $3,898 | $325 |

| Denton | $4,162 | $347 |

| DeWitt | $3,735 | $311 |

| Dickens | $4,303 | $359 |

| Dimmit | $2,665 | $222 |

| Donley | $4,400 | $367 |

| Duval | $3,226 | $269 |

| Eastland | $4,204 | $350 |

| Ector | $3,399 | $283 |

| Edwards | $2,868 | $239 |

| El Paso | $2,149 | $179 |

| Ellis | $3,793 | $316 |

| Erath | $4,175 | $348 |

| Falls | $3,104 | $259 |

| Fannin | $3,993 | $333 |

| Fayette | $3,354 | $279 |

| Fisher | $4,117 | $343 |

| Floyd | $4,237 | $353 |

| Foard | $4,383 | $365 |

| Fort Bend | $6,180 | $515 |

| Franklin | $3,527 | $294 |

| Freestone | $3,496 | $291 |

| Frio | $2,754 | $230 |

| Gaines | $3,514 | $293 |

| Galveston | $5,114 | $426 |

| Garza | $4,115 | $343 |

| Gillespie | $2,672 | $223 |

| Glasscock | $3,623 | $302 |

| Goliad | $4,467 | $372 |

| Gonzales | $3,275 | $273 |

| Gray | $4,349 | $362 |

| Grayson | $4,354 | $363 |

| Gregg | $3,114 | $260 |

| Grimes | $3,685 | $307 |

| Guadalupe | $2,839 | $237 |

| Hale | $4,002 | $334 |

| Hall | $4,384 | $365 |

| Hamilton | $3,832 | $319 |

| Hansford | $4,258 | $355 |

| Hardeman | $4,521 | $377 |

| Hardin | $4,338 | $362 |

| Harris | $5,829 | $486 |

| Harrison | $3,397 | $283 |

| Hartley | $3,925 | $327 |

| Haskell | $4,498 | $375 |

| Hays | $2,613 | $218 |

| Hemphill | $4,329 | $361 |

| Henderson | $3,497 | $291 |

| Hidalgo | $3,334 | $278 |

| Hill | $3,737 | $311 |

| Hockley | $3,682 | $307 |

| Hood | $4,212 | $351 |

| Hopkins | $3,649 | $304 |

| Houston | $3,358 | $280 |

| Howard | $3,678 | $307 |

| Hudspeth | $2,360 | $197 |

| Hunt | $3,846 | $321 |

| Hutchinson | $4,233 | $353 |

| Irion | $3,627 | $302 |

| Jack | $4,550 | $379 |

| Jackson | $4,923 | $410 |

| Jasper | $3,996 | $333 |

| Jeff Davis | $2,271 | $189 |

| Jefferson | $4,065 | $339 |

| Jim Hogg | $2,777 | $231 |

| Jim Wells | $3,712 | $309 |

| Johnson | $3,990 | $333 |

| Jones | $4,193 | $349 |

| Karnes | $3,559 | $297 |

| Kaufman | $3,912 | $326 |

| Kendall | $2,714 | $226 |

| Kenedy | $4,394 | $366 |

| Kent | $4,292 | $358 |

| Kerr | $2,637 | $220 |

| Kimble | $3,023 | $252 |

| King | $4,648 | $387 |

| Kinney | $2,487 | $207 |

| Kleberg | $3,561 | $297 |

| Knox | $4,400 | $367 |

| La Salle | $2,800 | $233 |

| Lamar | $3,778 | $315 |

| Lamb | $3,759 | $313 |

| Lampasas | $2,849 | $237 |

| Lavaca | $3,764 | $314 |

| Lee | $2,963 | $247 |

| Leon | $3,395 | $283 |

| Liberty | $4,837 | $403 |

| Limestone | $3,483 | $290 |

| Lipscomb | $4,531 | $378 |

| Live Oak | $4,119 | $343 |

| Llano | $2,925 | $244 |

| Loving | $2,699 | $225 |

| Lubbock | $3,937 | $328 |

| Lynn | $3,874 | $323 |

| Madison | $3,353 | $279 |

| Marion | $3,589 | $299 |

| Martin | $3,648 | $304 |

| Mason | $3,043 | $254 |

| Matagorda | $5,247 | $437 |

| Maverick | $2,423 | $202 |

| Mcculloch | $3,687 | $307 |

| Mclennan | $3,315 | $276 |

| Mcmullen | $3,008 | $251 |

| Medina | $2,805 | $234 |

| Menard | $3,197 | $266 |

| Midland | $3,397 | $283 |

| Milam | $2,983 | $249 |

| Mills | $3,694 | $308 |

| Mitchell | $3,880 | $323 |

| Montague | $4,380 | $365 |

| Montgomery | $4,095 | $341 |

| Moore | $4,022 | $335 |

| Morris | $3,477 | $290 |

| Motley | $4,360 | $363 |

| Nacogdoches | $3,205 | $267 |

| Navarro | $3,614 | $301 |

| Newton | $3,815 | $318 |

| Nolan | $4,021 | $335 |

| Nueces | $4,556 | $380 |

| Ochiltree | $4,517 | $376 |

| Oldham | $4,065 | $339 |

| Orange | $5,190 | $433 |

| Palo Pinto | $4,520 | $377 |

| Panola | $3,211 | $268 |

| Parker | $4,296 | $358 |

| Parmer | $3,738 | $311 |

| Pecos | $2,759 | $230 |

| Polk | $3,926 | $327 |

| Potter | $4,201 | $350 |

| Presidio | $2,340 | $195 |

| Rains | $3,691 | $308 |

| Randall | $4,192 | $349 |

| Reagan | $3,391 | $283 |

| Real | $2,761 | $230 |

| Red River | $3,628 | $302 |

| Reeves | $2,695 | $225 |

| Refugio | $4,557 | $380 |

| Roberts | $4,366 | $364 |

| Robertson | $3,106 | $259 |

| Rockwall | $3,993 | $333 |

| Runnels | $3,910 | $326 |

| Rusk | $3,289 | $274 |

| Sabine | $3,364 | $280 |

| San Augustine | $3,273 | $273 |

| San Jacinto | $4,011 | $334 |

| San Patricio | $4,489 | $374 |

| San Saba | $3,231 | $269 |

| Schleicher | $3,066 | $256 |

| Scurry | $4,184 | $349 |

| Shackelford | $4,296 | $358 |

| Shelby | $3,122 | $260 |

| Sherman | $4,125 | $344 |

| Smith | $3,308 | $276 |

| Somervell | $4,163 | $347 |

| Starr | $2,721 | $227 |

| Stephens | $4,323 | $360 |

| Sterling | $3,657 | $305 |

| Stonewall | $4,378 | $365 |

| Sutton | $2,868 | $239 |

| Swisher | $4,033 | $336 |

| Tarrant | $4,237 | $353 |

| Taylor | $4,041 | $337 |

| Terrell | $2,545 | $212 |

| Terry | $3,824 | $319 |

| Throckmorton | $4,325 | $360 |

| Titus | $3,475 | $290 |

| Tom Green | $3,657 | $305 |

| Travis | $2,621 | $218 |

| Trinity | $3,378 | $281 |

| Tyler | $3,852 | $321 |

| Upshur | $3,379 | $282 |

| Upton | $3,592 | $299 |

| Uvalde | $2,721 | $227 |

| Val Verde | $2,609 | $217 |

| Van Zandt | $3,642 | $303 |

| Victoria | $5,135 | $428 |

| Walker | $3,720 | $310 |

| Waller | $5,142 | $428 |

| Ward | $3,242 | $270 |

| Washington | $3,614 | $301 |

| Webb | $2,514 | $209 |

| Wharton | $5,831 | $486 |

| Wheeler | $4,536 | $378 |

| Wichita | $4,456 | $371 |

| Wilbarger | $4,712 | $393 |

| Willacy | $3,587 | $299 |

| Williamson | $2,698 | $225 |

| Wilson | $2,818 | $235 |

| Winkler | $3,209 | $267 |

| Wise | $4,390 | $366 |

| Wood | $3,553 | $296 |

| Yoakum | $3,686 | $307 |

| Young | $4,450 | $371 |

| Zapata | $2,287 | $191 |

| Zavala | $2,472 | $206 |

Average home insurance rates in Texas' largest cities

Among the cities listed below, Houston has the most expensive home insurance rates in Texas at an average of $6,008 a year, largely due to it's proximity to the coast and vulnerability to hurricanes. El Paso has the cheapest home insurance in Texas at an average of $2,144.

The following are average rates for some of the state's largest cities for a policy with $300,000 dwelling coverage, a $1,000 deductible, and $100,000 in liability protection.

| City | Avg annual premium | % of state average | % of national average |

|---|---|---|---|

| Arlington | $4,244 | 10% more | 63% more |

| Austin | $2,609 | 32% less | >1% more |

| Corpus Christi | $4,862 | 23% more | 82% more |

| Dallas | $4,129 | 7% more | 59% more |

| El Paso | $2,144 | 44% less | 18% less |

| Fort Worth | $4,226 | 10% more | 62% more |

| Houston | $6,008 | 52% more | 125% more |

| Lubbock | $3,911 | 2% more | 50% more |

| Plano | $4,090 | 6% more | 57% more |

| San Antonio | $2,721 | 29% less | 5% more |

How to lower homeowners insurance rates in Texas

There are several ways to reduce your Texas home insurance costs:

- Bundle your home and auto. It can cut your costs by 18% on average, according to our analysis of the best home insurance discounts.

- Make your home more disaster-resistant. Installing a new roof, updating wiring or plumbing, and installing hurricane glass or accordion shutters all make your home more insurable and can earn you lower rates.

- Ask about discounts. You may be able to easily qualify for additional discounts such as paperless billing.

- Increase your deductible. A higher deductible means lower rates; just ensure you can afford it if you have to pay it.

Home insurance discounts in Texas for 2025

A burglar alarm can earn you a 6% discount, while deadbolts and bundling save 5% each. You can stack these discounts to save even more.

Home insurance discounts are one of the best ways to save on homeowners insurance in Texas. Discounts vary by carrier; take a look at the available discounts and average savings for top companies below.

| Discount category | Premium before discount | Premium after discount | Discount percentage |

|---|---|---|---|

| Age of home | $5,830 | $5,249 | 10% |

| All Perils Deductible | $5,441 | $4,529 | 18% |

| Automatic payments | $4,721 | $4,627 | 2% |

| Bundle | $5,319 | $5,042 | 5% |

| Burglar Alarm | $5,108 | $4,785 | 6% |

| Construction type | $5,486 | $4,924 | 10% |

| Deadbolt | $5,357 | $5,071 | 5% |

| Fire Alarm | $5,267 | $5,148 | 2% |

| Insurance Score Alignment | $5,419 | $4,532 | 19% |

| Loyalty | $4,721 | $4,696 | 1% |

| New Home | $5,449 | $3,255 | 40% |

| Separate Wind-Hail Deductible | $5,247 | $4,660 | 14% |

| Sprinklers | $5,357 | $4,899 | 9% |

| Upgrades | $5,391 | $5,009 | 8% |

| Water Safety System | $4,721 | $4,647 | 2% |

Methodology

Insurance.com worked with Quadrant Information Services to field homeowners insurance rates in all 50 states and Washington, D.C. We analyzed 20,739,560 insurance quotes from 81 insurance companies across 34,588 ZIP codes to determine the average premiums.

The insurance rates are based on a sample profile of a homeowner with good credit and the following coverage level:

- $300,000 dwelling coverage

- $300,000 liability protection

- $1,000 deductible

- 2% hurricane deductible where appropriate.

To rank insurance companies, we used three important factors: average annual cost, NAIC complaint ratio and AM Best financial stability rating. Find the full best insurance companies rating methodology here. The quoted insurance rates are for comparison purposes, and your rates will vary.

FAQ: Texas home insurance

Why is home insurance so expensive in Texas?

Texas home insurance rates are higher than average due to the many weather risks in the state, from hurricanes to tornadoes and even, in recent years, winter storms.

How much is flood insurance in Texas?

The average annual cost of a National Flood Insurance Program (NFIP) policy in Texas is $698 a year. You can also buy flood insurance through a private flood insurance company; rates vary. A separate flood insurance policy is the only way to cover flood damage.

What if I have trouble getting home insurance in Texas?

The Fair Access to Insurance Requirements (FAIR) Plan is a state-mandated program that can provide insurance for individuals who are having trouble protecting their property because insurers consider them high risk. In Texas, the Texas Fair Plan Association (TFPA) provides homeowners insurance when no one else will.

How do I file a complaint about a Texas insurance company?

If you have a dispute that you cannot resolve, you can file a complaint with the Texas Department of Insurance. To file a complaint, use the Texas Department of insurance (TDI) online complaint system. The system allows you to attach up to 24 pages of supporting documents.

If you have questions, call the TDI Help Line at 800-252-3439 from 8 a.m. to 5 p.m. Central time.