- Best homeowners insurance company in Virginia: Virginia Farm Bureau

- Cheapest home insurance company in Virginia: American Family

- How much is homeowners insurance in Virginia?

- Virginia home insurance rates by ZIP code

- Virginia homeowners insurance rates by county

- Compare homeowners insurance rates by city in Virginia

- How much homeowners insurance do you need in Virginia?

- Methodology

- FAQ: Virginia home insurance

- Compare Virginia homeowners insurance rates with other states

Best homeowners insurance company in Virginia: Virginia Farm Bureau

The best home insurance company in Virginia, according to our ratings, is Virginia Farm Bureau. Erie Insurance, State Farm, American Family and Nationwide are among the other top home insurance companies in Virginia.

The total Insurance.com score is calculated on a scale of 5 using these factors: price, NAIC complaints, and A.M. Best financial ratings.

Cheapest home insurance company in Virginia: American Family

American Family has the most affordable rates in all coverage levels except for $600,000 and $1,000,000 dwelling coverage.

The table below shows home insurance rates for Virginia insurers for five different levels of dwelling coverage, each with $300,000 in liability and a $1,000 deductible.

| Company | $200,000 | $300,000 | $400,000 | $600,000 | $1,000,000 |

|---|---|---|---|---|---|

| American Family | $674 | $871 | $1,213 | $2,300 | $4,681 |

| Virginia Farm Bureau | $819 | $1,080 | $1,315 | $1,929 | $3,298 |

| Progressive | $1,070 | $1,363 | $1,687 | $2,365 | $3,776 |

| State Farm | $1,150 | $1,451 | $1,749 | $2,385 | $3,534 |

| Erie Insurance | $1,227 | $1,706 | $2,220 | $3,124 | $5,203 |

| Nationwide | $1,221 | $1,732 | $2,031 | $2,934 | $4,842 |

| Allstate | $1,611 | $1,857 | $2,181 | $2,974 | $4,705 |

| Farmers | $2,142 | $3,186 | $4,434 | $7,046 | $12,004 |

| Travelers | $4,398 | $5,116 | $6,284 | $9,092 | $15,303 |

How much is homeowners insurance in Virginia?

The average cost of homeowners insurance in Virginia is $2,151 a year or $179 a month. This is based on coverage of:

- $300,000 dwelling

- $300,000 liability

- $1,000 deductible.

- 2% Hurricane deductible

Rates vary based on a lot of factors, so you should compare quotes from several homeowners insurance companies to get the best deal.

Virginia home insurance rates by ZIP code

Since home insurance rates can vary greatly depending on where your home is located, it’s important to compare rates by ZIP code to see how areas stack up.

Use the home insurance calculator below to see the average rates in an area. Enter your ZIP code and coverage level to compare high and low premiums from major home insurers and see how much you can save by shopping around.

Home insurance calculator by ZIP code

Average home insurance rates in TexasMost & least expensive ZIP codes for homeowners insurance in Texas

| ZIP code | City | Highest rate |

|---|---|---|

| 77550 | Galveston | $10,164 |

| 77586 | El Lago | $9,906 |

| 77551 | Galveston | $9,536 |

| 77554 | Galveston | $9,358 |

| ZIP code | City | Lowest rate |

|---|---|---|

| 78559 | Iglesia Antigua | $1,956 |

| 78593 | Santa Rosa | $1,999 |

| 79915 | El Paso | $2,008 |

| 79905 | El Paso | $2,009 |

The Virginia State Corporation Commission says...

Ask your agent if he charges additional fees over and above his commission. Agents are allowed to charge fees for services, such as photocopying, mailing, and faxing, as long as the applicant or policyholder consents in writing before the services are performed. A schedule of fees must be kept in the agent's office. If you think your agent is charging too much, check with other agents to find out if they charge additional fees.

- The Virginia State Corporation CommissionWhat are the most expensive ZIP codes in Virginia for home insurance?

Virginia homeowners insurance rates are the most expensive for ZIP code 23356, with an average annual cost of $3,309.

The most expensive ZIP codes in Virginia are:

| ZIP code | Average annual rate |

|---|---|

| 23356 | $3,309 |

| 23337 | $3,280 |

| 23454 | $3,277 |

| 23354 | $3,232 |

| 23417 | $3,229 |

| 23303 | $3,214 |

What are the least expensive ZIP codes in Virginia for home insurance?

The cheapest ZIP code in Virginia for home insurance is 22301, with an average annual cost of $1,673. The top five cheapest ZIP codes are:

| ZIP code | Average annual rate |

|---|---|

| 22301 | $1,673 |

| 22201 | $1,705 |

| 22044 | $1,707 |

| 22207 | $1,707 |

| 22203 | $1,709 |

| 22332 | $1,716 |

Virginia homeowners insurance rates by county

Falls Church is the cheapest county in Virginia for homeowners insurance at an average of $130 a month. At $272 a month, Virginia Beach is the most expensive county.

Use the map below to compare average rates by county in Virginia to see which areas are cheaper.

| County | Average annual premium | Average monthly premium |

|---|---|---|

| Accomack | $3,004 | $250 |

| Albemarle | $1,775 | $148 |

| Alexandria | $1,583 | $132 |

| Alleghany | $1,976 | $165 |

| Amelia | $2,196 | $183 |

| Amherst | $1,907 | $159 |

| Appomattox | $2,088 | $174 |

| Arlington | $1,573 | $131 |

| Augusta | $1,797 | $150 |

| Bath | $2,011 | $168 |

| Bedford | $1,884 | $157 |

| Bedford City | $1,892 | $158 |

| Bland | $1,960 | $163 |

| Botetourt | $1,792 | $149 |

| Bristol | $1,984 | $165 |

| Brunswick | $2,439 | $203 |

| Buchanan | $2,401 | $200 |

| Buckingham | $2,017 | $168 |

| Buena Vista | $1,737 | $145 |

| Campbell | $1,983 | $165 |

| Caroline | $2,097 | $175 |

| Carroll | $2,016 | $168 |

| Charles City | $2,152 | $179 |

| Charlotte | $2,371 | $198 |

| Charlottesville | $1,734 | $144 |

| Chesapeake | $2,841 | $237 |

| Chesterfield | $1,958 | $163 |

| Clarke | $1,911 | $159 |

| Craig | $1,974 | $165 |

| Culpeper | $1,962 | $164 |

| Cumberland | $2,219 | $185 |

| Danville | $2,046 | $171 |

| Dickenson | $2,421 | $202 |

| Dinwiddie | $2,298 | $191 |

| Essex | $2,183 | $182 |

| Fairfax | $1,629 | $136 |

| Fairfax city | $1,621 | $135 |

| Falls Church | $1,560 | $130 |

| Fauquier | $1,818 | $151 |

| Floyd | $1,976 | $165 |

| Fluvanna | $1,873 | $156 |

| Franklin | $2,022 | $168 |

| Frederick | $1,876 | $156 |

| Fredericksburg | $1,775 | $148 |

| Galax | $1,994 | $166 |

| Giles | $1,972 | $164 |

| Gloucester | $2,382 | $198 |

| Goochland | $2,206 | $184 |

| Grayson | $2,027 | $169 |

| Greene | $1,912 | $159 |

| Greensville | $2,478 | $206 |

| Halifax | $2,340 | $195 |

| Hampton | $2,972 | $248 |

| Hanover | $1,883 | $157 |

| Harrisonburg | $1,778 | $148 |

| Henrico | $1,842 | $154 |

| Henry | $2,120 | $177 |

| Highland | $2,028 | $169 |

| Isle Of Wight | $2,629 | $219 |

| James City | $2,064 | $172 |

| King And Queen | $2,230 | $186 |

| King George | $2,013 | $168 |

| King William | $2,172 | $181 |

| Lancaster | $2,357 | $196 |

| Lee | $2,242 | $187 |

| Loudoun | $1,690 | $141 |

| Louisa | $1,945 | $162 |

| Lunenburg | $2,364 | $197 |

| Lynchburg | $1,952 | $163 |

| Madison | $2,087 | $174 |

| Mathews | $2,715 | $226 |

| Mecklenburg | $2,416 | $201 |

| Middlesex | $2,517 | $210 |

| Montgomery | $1,828 | $152 |

| Nelson | $1,972 | $164 |

| New Kent | $2,172 | $181 |

| Newport News | $2,515 | $210 |

| Newport News City | $2,476 | $206 |

| Norfolk | $2,942 | $245 |

| Northampton | $3,093 | $258 |

| Northumberland | $2,485 | $207 |

| Nottoway | $2,169 | $181 |

| Orange | $1,892 | $158 |

| Page | $1,867 | $156 |

| Patrick | $2,230 | $186 |

| Pittsylvania | $2,191 | $183 |

| Poquoson | $2,763 | $230 |

| Portsmouth | $2,813 | $234 |

| Powhatan | $2,034 | $170 |

| Prince Edward | $2,232 | $186 |

| Prince George | $2,285 | $190 |

| Prince William | $1,753 | $146 |

| Pulaski | $1,983 | $165 |

| Radford | $1,928 | $161 |

| Rappahannock | $2,094 | $174 |

| Richmond | $2,161 | $180 |

| Richmond City | $2,062 | $172 |

| Roanoke | $1,758 | $146 |

| Roanoke City | $1,774 | $148 |

| Rockbridge | $1,885 | $157 |

| Rockingham | $1,722 | $144 |

| Russell | $2,199 | $183 |

| Scott | $2,348 | $196 |

| Shenandoah | $1,867 | $156 |

| Smyth | $2,056 | $171 |

| Southampton | $2,585 | $215 |

| Spotsylvania | $1,838 | $153 |

| Stafford | $1,826 | $152 |

| Suffolk | $2,744 | $229 |

| Surry | $2,501 | $208 |

| Sussex | $2,377 | $198 |

| Tazewell | $2,101 | $175 |

| Virginia Beach | $3,268 | $272 |

| Warren | $1,855 | $155 |

| Washington | $2,023 | $169 |

| Westmoreland | $2,204 | $184 |

| Williamsburg | $2,071 | $173 |

| Winchester | $1,811 | $151 |

| Wise | $2,225 | $185 |

| Wythe | $1,984 | $165 |

| York | $2,400 | $200 |

Compare homeowners insurance rates by city in Virginia

The table below displays average rates across various cities, where home insurance rates are influenced by factors such as weather, crime, and property values. Virginia Beach has the highest premiums at $2,519, while Harrisonburg is the cheapest at $1,311.

City Annual insurance premium

How much homeowners insurance do you need in Virginia?

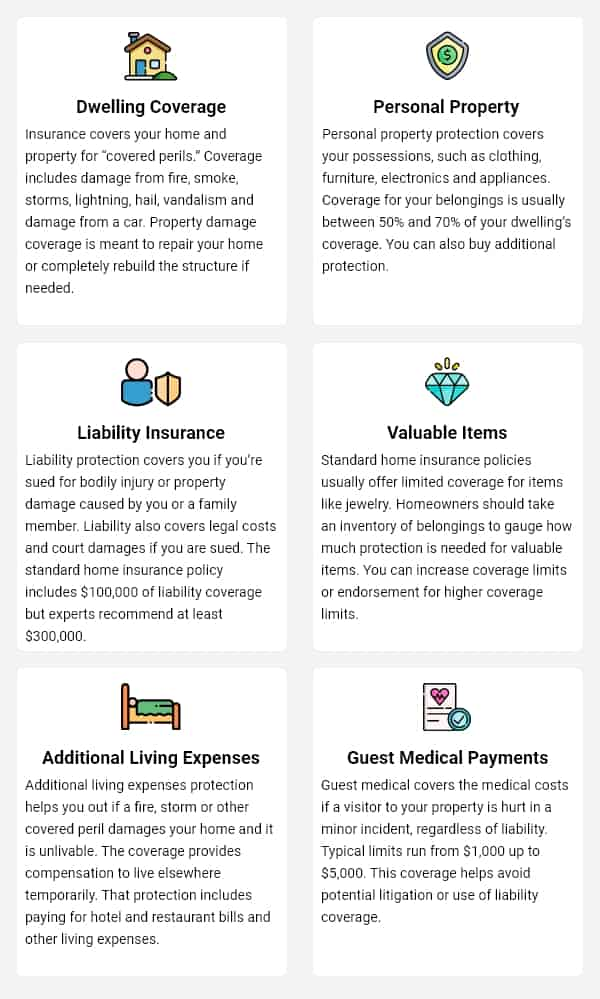

Unlike car insurance, there is no law requiring you to have home insurance or specifying the minimum coverage you need. To get the right coverage for your home, you need to consider:

- Replacement cost: How much would it cost to rebuild your home?

- Other structures: Typically 10% of your dwelling coverage, you may need more if you have outbuildings

- Personal property: Inventory your belongings to get an idea of how much coverage you need

To help you shop for coverage, here’s a look at the basic components of home insurance, and how much to get to make sure you’re not underinsured.

Methodology

Insurance.com worked with Quadrant Information Services to field homeowners insurance rates in all 50 states and Washington, D.C. We analyzed 20,739,560 insurance quotes from 81 insurance companies across 34,588 ZIP codes to determine the average premiums.

The insurance rates are based on a sample profile of a homeowner with good credit and the following coverage level:

- $300,000 dwelling coverage

- $300,000 liability protection

- $1,000 deductible

- 2% hurricane deductible where appropriate.

To rank insurance companies, we used three important factors: average annual cost, NAIC complaint ratio and AM Best financial stability rating. Find the full best insurance companies rating methodology here. The quoted insurance rates are for comparison purposes, and your rates will vary.

FAQ: Virginia home insurance

Is damage from wind and hail covered by home insurance in Virginia?

Wind and hail damage are typically covered by standard home insurance policies. However, some insurance companies may include a separate deductible for hurricane damage. Also, some home insurance policies do not cover cosmetic damage from hail.

Is flood damage covered by homeowners insurance in Virginia?

No. You need to buy a separate flood insurance policy from a private company or through the federal National Flood Insurance Program (NFIP). There is typically a 30-day waiting period for a new flood insurance policy to take effect, so you can’t wait until a hurricane is about to hit and expect to buy a policy that will protect you immediately.